Investing in better - for people and our planet

- 14 October 2022 (5 min read)

As long-term investors, pension trustees have always had to consider what the future might look like when putting investment strategies in place. But with the global environment in crisis, the question is not just, ‘what sort of future will we have?’ It is ‘can pension trustees help to create a better future while meeting their fiduciary responsibility to their members?’

Investors of all types are increasingly looking at how they can meet their financial goals while helping to address the environmental and social challenges that the world is facing today. For pension trustees, this has an added sense of urgency. As well as focusing on positive pension outcomes, they also need to consider how they can invest to help make a better world for their members and future generations to come.

These are not competing goals. In fact, we believe there is a virtuous circle where a desire for change can lead to innovation and development that can benefit investors with a long-term outlook.

Building sustainable economies and tackling social issues for a future that may look very different from today will require investment on a huge scale. Remaining ahead of the curve on policy, regulation and consumer behaviour creates clear opportunities for smaller companies through to the largest corporations. In turn, this provides opportunities for investors looking for long-term returns from the companies driving positive change.

Investing in companies that are driving a better future

With over £4 trillion of assets in UK pensions1 , pension schemes are well placed to invest in areas that deliver real, long-term positive impacts for society and the environment.

The demand is high: according to government research2 , 70% of the UK public want their money to go towards making a positive difference. Members – particularly younger members – are more likely to engage with and contribute to their schemes if they believe they are helping to make things better.

This is where impact investing comes in. Impact investors seek to invest in companies or projects that actively address areas such as climate change, biodiversity, and social inequality without giving up long-term returns. Impact investing has been built on strong private market foundations, but a rapidly growing roster of listed companies are coming into the space. This scaling up, through the development of innovative equity and bond strategies, is offering trustees greater choices in the ways they seek to deliver positive outcomes for their members and the world at large.

“Impact investing has been built on strong private market foundations, but a rapidly growing roster of listed companies are coming into the space."

A disciplined focus on prosperity for people and the planet

The 17 UN Sustainable Development Goals (SDGs) aim to mobilise global efforts to end poverty, fight inequality and protect and preserve the natural environment. Every SDG goal has targets that require a financial investment. Before COVID-19, the UN estimated however that unmet SDG financing needs stood at $2.5 trillion annually. Now, the estimated funding gap is a staggering $4.2 trillion.

Source: United Nations Sustainable Development Goals. For illustrative purposes only.

Filling this gap is the challenge for impact investors. As long-term investors, we can patiently deploy capital to the UN SDGs to help fund solutions for some of the most urgent social and environmental problems the world is facing.

This requires a broad focus. Climate change and the need to mitigate carbon emissions have been priorities for a number of years, and investment approaches focused on reducing emissions are well established.

We are beginning to see trustees look beyond climate change to reduce the impact of human activity on biodiversity loss. Addressing climate change requires finding ways to reduce the impact of human activity on nature and biodiversity loss. We can’t address these issues without simultaneously addressing some of the big social issues – such as food and energy security, access to shelter and overall health and wellbeing – that drive human behaviour and prosperity.

There is a lot at stake here. It wouldn’t be hyperbolic to say that the future of humanity depends on the choices we make over the decades. Establishing coherent strategies that address the UN SDGs is one way that we can focus capital on the areas that will make the most impact and could see the greatest financial benefit.

“We are beginning to see trustees look beyond climate change to address the impact of human activity on biodiversity loss.”

Translating impact themes into investment outcomes

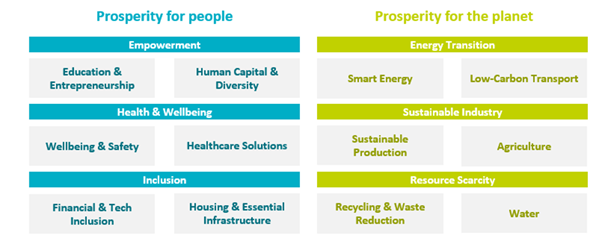

At AXA IM we start with a top-down research approach based around the UN SDGs. We categorise our impact research into two overarching themes: prosperity for people and prosperity for the planet. We’ve drilled down further into each category, to identify the 12 biggest global challenges that society and the environment are facing, and the solutions needed to address them. This process focuses our attention on where we can have the greatest financial and non-financial impact as investors.

AXA IM's listed impact investing themes

Source: AXA IM. For illustrative purposes only.

While the impact of a company’s operations is important, products and services that make a long-term contribution to a sustainable economy can also make a positive impact. We look for companies with a clear strategic commitment to making a material difference, through commercially viable solutions or technologies that mitigate or prevent negative impacts on the environment, or results in a social benefit.

We believe that a rigorous and consistent impact framework is vital. It not only helps us understand and quantify the impact outcomes of listed companies and track them against key performance indicators; it also provides a measure to hold companies accountable on environmental, social and governance (ESG) performance and the positive impact of their products and services.

There are five main areas we consider when we analyse the impact of what companies do: intentionality, materiality, additionality, negative externalities and measurability.

We pay particular attention to:

- Materiality – Are the impactful products or solutions they are providing significant to the business? Does it make a real difference to beneficiaries of the product or service? Does it materially improve the outlook for that industry?

- Additionality – Is the company’s product or service better than would otherwise be available? Does it have longevity and a sustainable competitive positioning over the long term?

- Measurability – Do we really understand what a company is doing? Can we track their progress with measurable key performance indicators (KPI) that are specific to their company?

Active engagement to drive real change

Actively engaging with the management of companies that we invest in on our clients’ behalf is one of the most powerful ways to bring about real change. It’s also vital to protecting shareholder value, and so it’s important to exercise voting rights and to influence corporate behaviour.

As a large investor, we can exercise significant influence when we engage with companies, either individually or in cooperation with other investors. We can encourage them to focus on UN SDG-aligned corporate behaviour to enhance the impact they make, while protecting long-term earnings by encouraging companies to improve upon on their weakest E, S and G areas.

While it’s important to maintain a disciplined separation between financial outcomes and our non-financial goals, we believe that the two are ultimately intertwined. We can help to safeguard the future of the world by providing capital to companies that seek to deliver technologies and solutions addressing the biggest challenges. Simultaneously, helping members access overarching long-term structural growth drivers that will deliver compound annual growth can ultimately help deliver attractive investment returns.

- U291cmNlOiBJQSAtIEludmVzdG1lbnQgTWFuYWdlbWVudCBTdXJ2ZXkgMjAyMC0yMDIxLnBkZiAodGhlaWEub3JnKSwgcGFnZSA1OA==

- U291cmNlOiBJbnZlc3RpbmcgaW4gYSBCZXR0ZXIgV29ybGQ6IFVuZGVyc3RhbmRpbmcgdGhlIFVLIHB1YmxpY+KAmXMgZGVtYW5kIGZvciBvcHBvcnR1bml0aWVzIHRvIGludmVzdCBpbiB0aGUgU3VzdGFpbmFibGUgRGV2ZWxvcG1lbnQgR29hbHMsIFVLIEhNIEdvdmVybm1lbnQsIDIwMTku

ACT range

Invest with purpose to support the transition to a more sustainable economy.

Find out moreDisclaimer

Not for Retail distribution. This marketing communication is intended exclusively for Professional, Institutional, Qualified or Wholesale Clients/Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

The use of the SDG Logo, including the colour wheel, and icons does not imply the endorsement of the United Nations of AXA Investment Managers, its products or services, or of its planned activities and does not constitute, explicitly or implicitly, a recommendation for an investment strategy. The United Nations does not assume any responsibility or liability for the activities of AXA Investment Managers, including with respect to any fundraising or commercial use of the SDG Logo, the SDG wheel or any of the 17 SDG icons.

The ESG data used in the investment process are based on ESG methodologies which rely in part on third party data, and in some cases are internally developed. They are subjective and may change over time. Despite several initiatives, the lack of harmonised definitions can make ESG criteria heterogeneous. As such, the different investment strategies that use ESG criteria and ESG reporting are difficult to compare with each other. Strategies that incorporate ESG criteria and those that incorporate sustainable development criteria may use ESG data that appear similar but which should be distinguished because their calculation method may be different.

Issued in the UK by AXA Investment Managers UK Limited, authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.© AXA Investment Managers,2022.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.