Fixed income carbon transition

Investing in the transition to Net Zero could help reduce climate-related risks and enhance long-term returns

Seizing the opportunity for a sustainable world and financial return

The move to Net Zero presents new risks and opportunities for investors. Our years of experience and depth of knowledge mean we are able to offer clients a pragmatic approach to sustainable investing to help you achieve your traditional financial and also sustainable objectives .

Climate Action Report

Our Climate Action Report has more information about the risks to investors from climate change.

Read the reportCombining our expertise in fixed income and sustainability

AXA Investment Managers is a world leader in fixed income investing. Our global team of analysts and portfolio managers across the fixed income spectrum provide ‘on the ground’ insights that help to build portfolios that aim to achieve investors' financial and non-financial objectives.

We started our first responsible investing mandate twenty years ago and have been at the forefront of sustainable investing ever since. Our parent group AXA joined the Net Zero Asset Owner Alliance in 2019 and we are a founding member of the Net Zero Asset Management Initiative.

These two areas of expertise come together in our Carbon Transition strategies. Our understanding of fixed income means we can make pragmatic and targeted decisions on reducing carbon exposure in portfolios that complement our financial objectives.

We build our carbon transition portfolios based on a three-step process:

A surge in the volume and quality of data available around climate risks has made it possible for investors to gain effective insights into how their portfolios are positioned in relation to climate-related risks.

As well as looking for current low-carbon issuers, we also believe investors should look to the carbon pathway of assets to find best-in-class companies targeting decarbonisation.

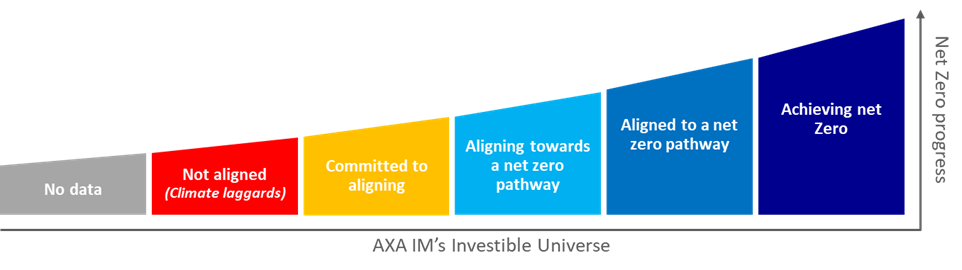

We consider bonds based on their position on a path towards full Net Zero alignment.

Our Net Zero Alignment Colours Framework

Source: AXA IM, March 2024. For illustrative purposes only.

We don’t automatically exclude bonds from issuers that are not yet aligned with net zero. We think investment and engagement is the best way to move the broader market towards Net Zero over time.

Disclaimer

Not for Retail distribution: This marketing communication is intended exclusively for Professional, Institutional or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

The value of investments may fall as well as rise and you may not get back the full amount invested.

Other risks associated with these funds:

Counterparty Risk: failure by any counterparty to a transaction (e.g. derivatives) with the Fund to meet its obligations may adversely affect the value of the Fund. The Fund may receive assets from the counterparty to protect against any such adverse effect but there is a risk that the value of such assets at the time of the failure would be insufficient to cover the loss to the Fund.

Derivatives: derivatives can be more volatile than the underlying asset and may result in greater fluctuations to the Fund's value. In the case of derivatives not traded on an exchange they may be subject to additional counterparty and liquidity risk.

Interest Rate Risk: fluctuations in interest rates will change the value of bonds, impacting the value of the Fund. Generally, when interest rates rise, the value of the bonds fall and vice versa. The valuation of bonds will also change according to market perceptions of future movements in interest rates.

Liquidity Risk: some investments may trade infrequently and in small volumes. As a result the Fund manager may not be able to sell at a preferred time or volume or at a price close to the last quoted valuation. The fund manager may be forced to sell a number of such investments as a result of a large redemption of shares in the Fund. Depending on market conditions, this could lead to a significant drop in the Fund's value and in extreme circumstances lead the Fund to be unable to meet its redemptions.

Credit Risk: the risk that an issuer of bonds will default on its obligations to pay income or repay capital, resulting in a decrease in Fund value. The value of a bond (and, subsequently, the Fund) is also affected by changes in market perceptions of the risk of future default. Investment grade issuers are regarded as less likely to default than issuers of high yield bonds.

Carbon transition risk: Certain Funds implement a carbon transition criteria within their responsible investment approach, which may use, where stated in a Fund’s investment policy, criteria aimed at selecting issuers either with a low carbon emissions intensity or with a clear and credible commitment to reduce their carbon emissions intensity. As a result, their respective performance may be different from a fund implementing a similar investment strategy which does not apply a carbon transition criteria within their responsible investment approach. The selection of assets may in part rely on third party data provided at the time of investment that may evolve over time.

Before making an investment, investors should read the relevant Prospectus and the Key Investor Information Document / scheme documents, which provide full product details including investment charges and risks. The information contained herein is not a substitute for those documents or for professional external advice.

The products or strategies discussed in this document may not be registered nor available in your jurisdiction. Please check the countries of registration with the asset manager, or on the web site https://www.axa-im.com/en/registration-map, where a fund registration map is available. In particular units of the funds may not be offered, sold or delivered to U.S. Persons within the meaning of Regulation S of the U.S. Securities Act of 1933. The tax treatment relating to the holding, acquisition or disposal of shares or units in the fund depends on each investor’s tax status or treatment and may be subject to change. Any potential investor is strongly encouraged to seek advice from its own tax advisors.

For more information on sustainability-related aspects please visit https://www.axa-im.com/what-is-sfdr

For investors located in the European Union :

Please note that the management company reserves the right, at any time, to no longer market the product(s) mentioned in this communication in the European Union by filing a notification to its supervision authority, in accordance with European passport rules.

In the event of dissatisfaction with AXA Investment Managers products or services, you have the right to make a complaint, either with the marketer or directly with the management company (more information on AXA IM complaints policy is available in English: https://www.axa-im.com/important-information/comments-and-complaints ). If you reside in one of the European Union countries, you also have the right to take legal or extra-judicial action at any time. The European online dispute resolution platform allows you to submit a complaint form (available at: https://ec.europa.eu/consumers/odr/main/index.cfm?event=main.home.chooseLanguage) and provides you with information on available means of redress (available at: https://ec.europa.eu/consumers/odr/main/?event=main.adr.show2).

Summary of investor rights in English is available on AXA IM website https://www.axa-im.com/important-information/summary-investor-rights. Translations into other languages are available on local AXA IM entities’ websites.

AXA Carbon Transition Sterling Buy and Maintain Credit Fund and AXA Carbon Transition Global Short Duration Bond Fund are sub-funds of the Irish-domiciled ICAV AXA IM World Access Vehicle, with registered address at 33 Sir John Rogerson’s Quai Dublin 2, and registered with the Central Bank of Ireland under number C154706. AXA Carbon Transition Sterling Buy and Maintain Credit Fund and AXA Carbon Transition Global Short Duration Bond Fund are collective asset-management vehicles under the European UCITS directive. They are managed by AXA Investment Managers Paris, a company incorporated under the laws of France, having its registered office located at Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, registered with the Nanterre Trade and Companies Register under number 353 534 506, and a Portfolio Management Company, holder of AMF approval no. GP 92008, issued on 7 April 1992.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.