Japan’s hidden tech investment potential

- 14 June 2024 (5 min read)

After a recent trip to Japan, Bradley Reynolds, portfolio manager on the tech team at AXA Investment Managers, surveys the potential the country holds for tech investors.

For those of use who grew up in the era of the Nintendo Entertainment System, the Sony Walkman and the Sega Megadrive, Japan seemed like the tech centre of the world. The rise of the new tech giants – predominantly in the US – has overshadowed the Japanese tech sector, but our recent trip to Tokyo revealed that innovation is creating fresh opportunities for investors.

Riding the AI wave

AI is the most powerful trend to emerge from the tech sector in recent years, and Japan has a lot of companies exposed to the AI value chain. These are predominately semiconductor equipment providers, and the initial Generative AI investment wave has made these companies – which provide the building blocks of AI – early beneficiaries, including Advantest (GPU testing), Disco (dicer & grinder) and Tokyo Electron (etching equipment).

As the initial investment phase begins to subside, we predict that we will see companies across the rest of the technology stack reap rewards. Two areas that we think worth keeping an eye on are robotics and video gaming.

AI will power the next generation of robots

AI has the potential to expand the range of problems robots are able to solve – especially if they are able to better understand and adapt to their surroundings. Nvidia calls this ‘physical AI’ and, as AI better understands physics, they predict a significant impact on the industrial sector. Nvidia has a robotics platform and I expect a growing number of collaboration partnerships to be announced with robotics companies as the platform develops.

We see robotics as one of the most exciting areas of the Japanese tech market, driven by structural changes in the labour market.

- Labour shortages and the rising cost of labour are long-term structural drivers for increased automation - labour shortages will be a significant challenge for businesses, especially in the manufacturing and warehouse industries.

- Fewer workers, particularly younger from demographics, are willing to undertake a career in these sectors due to low pay and the nature of the roles.

Technology is part of the solution, and we see the payback period from introducing automation becoming shorter as labour costs rise. As a result more and more areas are being considered for automation.

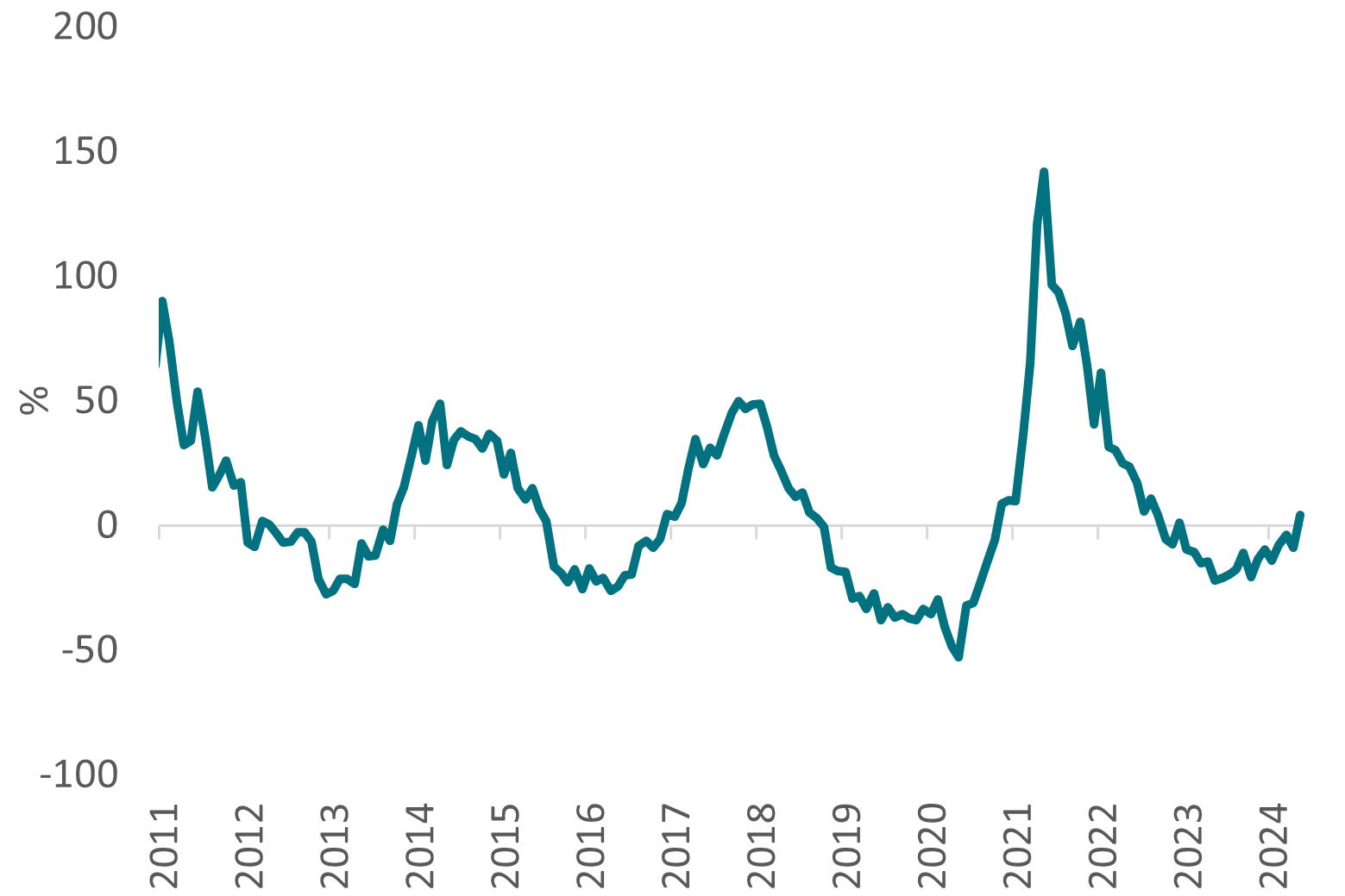

Additionally, we see signs of the start of a new manufacturing cycle on the horizon. The Japan Machine Tool Orders Index, a key leading indicator, troughed in Q4 2023, when orders were close to -20%, year-on-year, but is now improving, with momentum in positive territory. Manufacturing PMIs, new orders, and the US Federal Reserve’s business outlook and forecasts for capital expenditures also indicate that manufacturing activities should improve in the second half of this year.

Japan Machine Tool Orders Index is improving following a 2023 trough

Japan Machine Tool Orders Index, year on year, %

Source: Bloomberg/AXA IM, June 2024.

In this scenario, factory automation and warehouse automation related companies should benefit, such as Keyence, Mitsubishi Electric, Fanuc and Yaskawa Electric.

AI is feeding the growing army of gamers

When I was growing up, Japan’s domination of the gaming marketplace was one of the main reasons I saw it as the centre of the tech universe. Back then, gaming was still seen as kids’ stuff, but the gaming market has grown substantially and become very much a part of the mainstream entertainment universe.

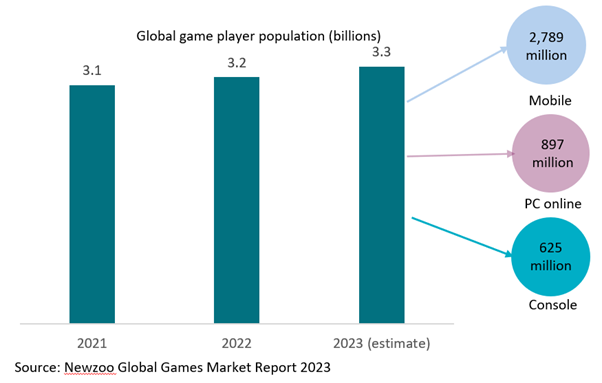

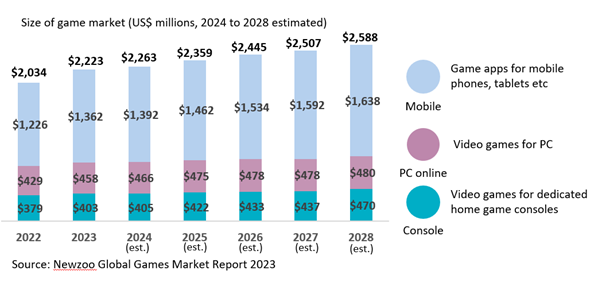

In 2023, there was a global population of three billion gamers, on consoles, PC and mobile devices, creating a market of over $200 billion (source: NewZoo Global Gaming Market Report 2023), and these numbers are only going to rise in the coming years.

Global game player population expected to grow to 3.3 billion

AI is already being deployed in the content creation, coding and localisation activities for computer games, and it is expected to deliver greater efficiencies to the game development process.

Nintendo and Sony are two of the biggest games companies, taking about 86% of the console gaming market share in 2023 (Source: Counterpoint Research, Global Smart Devices Shipments Tracker). As we start the year, we are anticipating an exciting new Nintendo console cycle coming up. This is always a pivotal moment in the gaming market due to the uniqueness of Nintendo consoles.

Game market set to break $250 billion

Reducing the environmental impact of the tech industry

Japan has never been a leader for responsible investing. Historically, Japanese companies have been criticized for having weaker governance practices than their western counterparts, leading to lower ESG scores. Additionally, there has been a perceived lack of emphasis on environmental and social initiatives compared to other developed nations. But this is changing.

The manufacture of computer chips is costly in terms of energy and water usage, which is leading many chip manufacturers companies to look at how they can be more efficient and, therefore, “greener”, in their approach. A great example of a company providing solutions in this area is Kurita Water Industries which provides various water treatment services for the semiconductor industry, including ultrapure water production, wastewater treatment, and cleaning and etching process solutions.

These services are essential for ensuring high-quality water usage in the semiconductor manufacturing processes and advancements in recycling and reuse systems are helping to reduce the environmental footprint of their customers. Kurita estimates that 50-70% of water is being recycled today but suggest they have the technology to take that closer to 100% and expect more and more customers to adopt their solutions over time.

An improving backdrop for Japanese equities

Governance is also improving in Japanese companies, with a notable shift in corporate attitude towards share prices following a directive from the Tokyo Stock Exchange. This directive has led to an increase in companies announcing measures to elevate their share prices, reflecting a change in mindset among many corporations.

The Bank of Japan's historic shift in monetary policy has triggered inflation and rising wages, prompting changes in consumer and corporate spending habits, particularly in areas like AI and low emissions production. Share buyback announcements are at record levels, reflecting improved attitudes towards shareholders.

Japanese equities across all sectors are experiencing a strong upward trend, but despite the market's strong performance, foreign investors remain underweight. The potential for a stronger Yen, coupled with favorable valuations and positive flows, suggests an attractive risk-reward profile. As global markets reach new highs, Japan continues to offer appeal, with buying the dip appearing to be the forward path.

Disclaimer

Not for Retail distribution: This marketing communication is intended exclusively for Professional, Institutional or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly. This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date. All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document. Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Companies shown are for illustrative purposes only as of 14 June 2024 and may no longer be in the portfolio later. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

The information contained herein is based on the companies’ commitment toward climate transition and is not a reliable indicator of their future financial results.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.