US clean energy and power demand: A more positive outlook than meets the eye

- 27 January 2025 (10 min read)

KEY POINTS

Donald Trump’s return to the White House began with a series of executive orders and declarations, including announcing a “national energy emergency” and plans to “drill, baby, drill”1 .

He also ordered the withdrawal from the Paris Agreement on climate change, rolled back clean energy initiatives including temporarily pausing leasing and permitting for wind projects and lifting export restrictions on liquified natural gas2 .

However, despite these announcements, we still believe the US clean energy sector continues to offer potential investment opportunities, given the backdrop of robustly rising power demand.

- PGEgaHJlZj0iaHR0cHM6Ly93d3cud2hpdGVob3VzZS5nb3YvcmVtYXJrcy8yMDI1LzAxL3RoZS1pbmF1Z3VyYWwtYWRkcmVzcy8iPlRoZSBJbmF1Z3VyYWwgQWRkcmVzcyAtIFRoZSBXaGl0ZSBIb3VzZTwvYT4vPGEgaHJlZj0iaHR0cHM6Ly93d3cud2hpdGVob3VzZS5nb3YvcHJlc2lkZW50aWFsLWFjdGlvbnMvMjAyNS8wMS9kZWNsYXJpbmctYS1uYXRpb25hbC1lbmVyZ3ktZW1lcmdlbmN5LyI+REVDTEFSSU5HIEEgTkFUSU9OQUwgRU5FUkdZIEVNRVJHRU5DWTwvYT4=

- PGEgaHJlZj0iaHR0cHM6Ly93d3cudGhlZ3VhcmRpYW4uY29tL2Vudmlyb25tZW50LzIwMjUvamFuLzIyL3RydW1wLWJpZy1vaWwtZW5lcmd5LXByaW9yaXRpZXMtZXhwbGFpbmVkIj5FeHBsYWluZWQ6IGhvdyBUcnVtcOKAmXMgZGF5IG9uZSBvcmRlcnMgcmV2ZWFsIGEgV2hpdGUgSG91c2UgZm9yIGJpZyBvaWw8L2E+

New generation

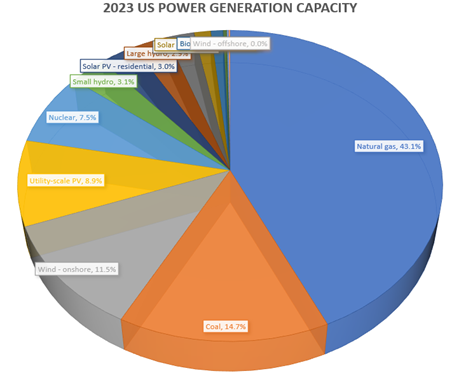

It’s vital to recognise the size and diversity of the technologies the US uses to generate power today.

Data source: BNEF January 2025. For illustrative purposes only.

The world’s largest economy has 1,336 Gigawatts (GW) of installed power generation capacity - approximately 18 times that of the UK3 . The chart above shows how this breaks down by source.

The US’s energy generation mix is well diversified with 40% of capacity coming from renewables (including nuclear). However, 15% of power capacity remains coal-powered, which will undoubtedly diminish in the coming years given its unfavourable economics and the multitude of decarbonisation commitments amongst utility firms.

Until recently, fuel switching has been driving growth in renewables. However, we are now in an era of power demand growth, driven by power-hungry artificial intelligence (AI) and domestic reindustrialisation. For example, data centres consumed an estimated 460 terawatt hours (TWh) of electricity globally, which is expected to jump to 1,580 TWh by 2034 – about the same as India’s entire energy demand4 .

For decades, efficiency initiatives like improved insulation and switching to LED lighting have offset higher demand (which tends to follow economic growth). This relationship is now decoupling, with the sector scrambling to adapt.

- Qk5FRiwgSmFudWFyeSAyMDI1

- PGEgaHJlZj0iaHR0cHM6Ly9pZWEuYmxvYi5jb3JlLndpbmRvd3MubmV0L2Fzc2V0cy8xOGYzZWQyNC00YjI2LTRjODMtYTNkMi04YTFiZTUxYzhjYzgvRWxlY3RyaWNpdHkyMDI0LUFuYWx5c2lzYW5kZm9yZWNhc3R0bzIwMjYucGRmIj5FbGVjdHJpY2l0eSAyMDI0IC0gQW5hbHlzaXMgYW5kIGZvcmVjYXN0IHRvIDIwMjY8L2E+LzxhIGhyZWY9Imh0dHBzOi8vd3d3LmJsb29tYmVyZy5jb20vZ3JhcGhpY3MvMjAyNC1haS1kYXRhLWNlbnRlcnMtcG93ZXItZ3JpZHMvIj5BSXMgSW5zYXRpYWJsZSBOZWVkIGZvciBFbmVyZ3kgaXMgU3RyYWluaW5nIEdsb2JhbCBQb3dlciBHcmlkczwvYT4=

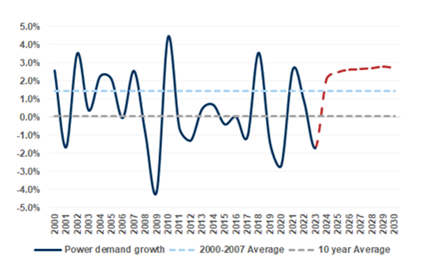

Demand growth

The chart below shows that US power demand growth was weak between 2000 and 2020 – averaging 1% - but is forecasted to increase from 2024 onwards. A 2%-3% increase in the rate of growth per annum would be significant, representing a doubling or tripling of the historical rate.

New estimates suggest that overall US power demand could grow at a compound annual rate of 3.1% between 2020 and 2040, compared to 0.1% between 2010 and 20205 .

This increasing demand underlines what we believe is a long-term trend, with potential investment opportunities across the spectrum, from power companies to those involved in the energy and equipment supply chain.

- V29sZmUgUmVzZWFyY2gsIGNpdGluZyBNY0tpbnNleSBkYXRhLCAxNiBKYW51YXJ5IDIwMjU=

US power demand growth

Source: EIA, Goldman Sachs Investment Research. For illustrative purposes only.

Domestic reindustrialisation constrained by power availability

Trump’s planned industrial renaissance, characterised by onshoring energy-intensive industries including auto manufacturers and semiconductor firms, is already being limited by supply-side constraints.

Commentary from specialists in developing new energy infrastructure highlights this, noting multi-year queues for new projects to be connected to the grid.

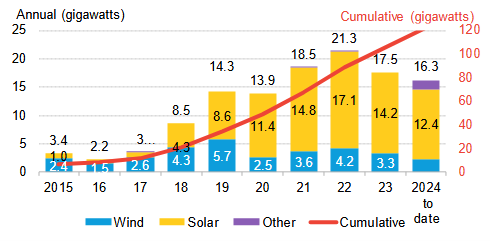

The chart below shows growing volumes of Power Purchase Agreements (PPAs), albeit with the sector catching its breath in 2023 as interest rates rose. PPAs have become the de facto vehicle for large so-called offtakers (the companies and organisations that purchase power) to secure power supply at an agreed price for years into the future. We are also hearing anecdotal evidence of rising PPA prices, corroborating the demand/supply imbalance. However, there is sparse pricing data given its commercial sensitivity and the high fragmentation of offtakers.

Annual US corporate PPAs, by technology

Source: BNEF, January 2025. For illustrative purposes only.

De-regulation should alleviate permit friction

One of Trump’s policy priorities is to reduce government bureaucracy and inefficiency. Permitting new energy projects has been notoriously slow in recent years due to understaffed government departments and burdensome environmental criteria.

In an executive order on “unleashing American energy”6 , Trump aims to cut out the red tape, and speed up energy projects, potentially constraining the remit of the National Environmental Policy Act (NEPA), from which many permit requirements currently stem. A rollback of NEPA power would be controversial, but it also highlights the irony of environmental regulation delaying investment in (some) projects clearly designed to benefit the planet.

- PGEgaHJlZj0iaHR0cHM6Ly93d3cud2hpdGVob3VzZS5nb3YvcHJlc2lkZW50aWFsLWFjdGlvbnMvMjAyNS8wMS91bmxlYXNoaW5nLWFtZXJpY2FuLWVuZXJneS8iPlVOTEVBU0hJTkcgQU1FUklDQU4gRU5FUkdZPC9hPg==

ITCs and PTCs: Unlikely to be repealed

Trump immediately revoked former President Joe Biden’s previous executive order to make half of all new vehicles sold in 2030 electric7 . We think the Republicans will also attack certain aspects of the Inflation Reduction Act (IRA)8 - namely advanced manufacturing credits - while leaving other core aspects unchanged. EV and advanced manufacturing credits are two components running the most ‘over budget’. They are also newer aspects of the IRA, compared to investment tax credits (ITCs) and production tax credits (PTCs), and therefore less entrenched in their end markets.

Overall, this will allow the Republicans to demonstrate action on Biden’s IRA while maintaining funding for newly created jobs in ‘red’ states. It is worth remembering under the first Trump administration, ITCs and PTCs were in fact rolled forward, demonstrating a likely nuanced approach in re-shaping this policy. Some form of policy continuation and predictability is key to the clean energy sector, which has a long duration business cycle. For example, given current shortages of key components like transformers, we are seeing developers ordering for projects as far into the future as 2030.

- PGEgaHJlZj0iaHR0cHM6Ly93d3cud2hpdGVob3VzZS5nb3YvcHJlc2lkZW50aWFsLWFjdGlvbnMvMjAyNS8wMS91bmxlYXNoaW5nLWFtZXJpY2FuLWVuZXJneS8iPlVOTEVBU0hJTkcgQU1FUklDQU4gRU5FUkdZPC9hPg==

- TGF1bmNoZWQgaW4gMjAyMiB1bmRlciBQcmVzaWRlbnQgSm9lIEJpZGVuLCB0aGUgSW5mbGF0aW9uIFJlZHVjdGlvbiBBY3QgYWltZWQgdG8gdXNoZXIgaW4gYSBuZXcgd2F2ZSBvZiBncm93dGggYW5kIGlubm92YXRpb24sIHdpdGggbmV3IHNwZW5kaW5nIGFuZCB0YXggYnJlYWtzIGZvciBpbmR1c3RyaWVzIGluY2x1ZGluZyBjbGVhbiBlbmVyZ3ksIHRyYW5zcG9ydGF0aW9uIGFuZCBhZ3JpY3VsdHVyZS4=

Clean energy – wind, solar and storage – is the cheapest form of new generation

It is well recognised that renewables are cheaper than conventional fuel sources.

In addition to the economics, supply of new gas turbines remains very tight (there are multi-year waiting lists for delivery) and renewables can be developed as quickly as six months. Power buyers increasingly cite ‘time to power’ – the period between signing a PPA and the power coming online – as a priority. This is driven by high levels of competition in offtakers’ markets; receiving additional power supply might be necessary to support a new product cycle, which in turn could support market share gain.

The next stage

Economics, growth and a continued climate of innovation and competition mean US power demand is likely to remain robust in the coming years, in turn also supporting the prospects of clean energy and its supply chains.

While Trump has made several negative comments on clean energy, we believe the fundamentals are better than current sentiment implies. We also welcomed the relatively modest share price weakness across parts of the clean energy sector following the news of Trump’s victory in November.

At the same time, his support for AI and technology is well documented. The Stargate Project, announced in January, is a $500bn AI infrastructure venture where the plan is to build data centres around the US. Behind the programme are two US tech giants, OpenAI and Oracle, Japanese investment firm Softbank and MGX, an investment arm of the United Arab Emirates government9 .

Continued strong demand for AI and data centres reinforces our conviction, given the spectrum of beneficiaries including power suppliers, data centre equipment manufacturers and engineering, procurement and construction companies.

Nonetheless the principal risk remains that the US economy is stronger than we - and the Federal Reserve – believe, and the Trump administration’s growth agenda turns out to be inflationary. This could slow interest rate cuts, or even lead to higher rates, which would hurt clean energy. We believe the largest clean energy companies are better able to adapt to a more challenging clean energy financing market thus offering potentially attractive investment opportunities.

And a great deal of financing is needed - annual global investment in renewable energy needs to triple to $1.5trn every year by 2030, according to the official progress report on COP28 goals10 .

We believe that appetite for renewable energy will continue to grow, given its potential for greater energy independence, lower costs and its important role in mitigating climate change. The global energy sector needs to move away from fossil-based fuels towards greener alternatives – if it does not, it will also jeopardise the global economy and the prospect of a prosperous, sustainable future.

Against this backdrop, we continue to see potential opportunities in US renewable energy, with a positive outlook for the sector over the longer term.

- PGEgaHJlZj0iaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYXJ0aWNsZXMvY3k0bTg0ZDJ4ejJvIj5UZWNoIGdpYW50cyBhcmUgcHV0dGluZyAkNTAwYm4gaW50byBTdGFyZ2F0ZSB0byBidWlsZCB1cCBBSSBpbiBVUzwvYT4=

- PGEgaHJlZj0iaHR0cHM6Ly93d3cuaXJlbmEub3JnL05ld3MvcHJlc3NyZWxlYXNlcy8yMDI0L09jdC9HbG9iYWwtR29hbC1vZi1UcmlwbGluZy1SZW5ld2FibGVzLU5lZWRzLVVTRC0xLXBvaW50LTUtVHJpbGxpb24tSW52ZXN0bWVudC1QZXItWWVhciM6fjp0ZXh0PUZ1cnRoZXJtb3JlJTJDJTIwYW5udWFsJTIwaW52ZXN0bWVudCUyMGluJTIwcmVuZXdhYmxlLENvbnNlbnN1cyUyMGF0JTIwQ09QMjglMjBpbiUyMER1YmFpIj5HbG9iYWwgR29hbCBvZiBUcmlwbGluZyBSZW5ld2FibGVzIE5lZWRzIFVTRCAxLjUgVHJpbGxpb24gSW52ZXN0bWVudCBQZXIgWWVhcjwvYT4=

Subscribe to updates

Have our latest insights delivered straight to your inbox

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2025 AXA Investment Managers. All rights reserved

Image source: Getty Images

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.