Thematic equities in focus - April

- 28 April 2020 (10 min read)

The Evolving Economy in a post-COVID-19 world

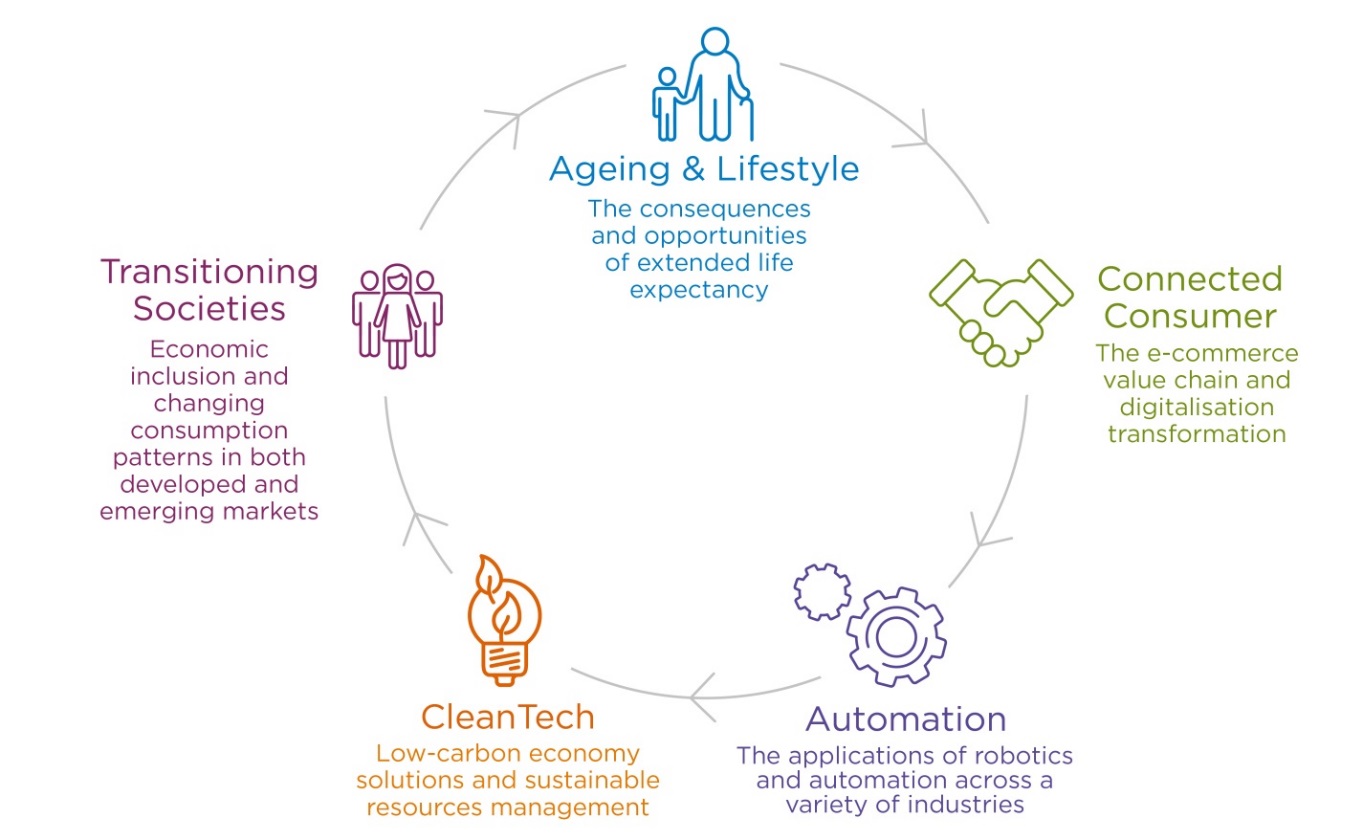

The spread of the COVID-19 virus into a global pandemic will likely have profound short- and longer-term implications for the global economy. Whilst it’s hard to determine the path to normalisation, we believe that our Evolving Economy is well positioned to navigate the changing economic landscape of a post-COVID-19 world with its exposure towards the 5 identified long-term secular growth themes:

Today, we can genuinely argue that most people in the world are facing a “lockdown” situation – from the South African township in Soweto to the 7th Parisian upper class district – with different degrees of confinement When facing a pandemic situation such as this, every member of the population – regardless of social origin – is coming back to the basics: how to keep eating, how to protect from the disease and how to maintain income generation for the family.

And this is where our Connected Consumer theme has held up relatively well in this challenging environment with a compendium of companies tackling several of these vital basics. During this unprecedented period where governments are asking populations to stay at home for an extended period, it is apparent that more consumers are starting to purchase essentials online via E-commerce platforms; whilst increasing their time spent on social media and online video platforms, driving a higher share of advertising to these platforms. In developed countries, the population has also gradually moved towards a a remote working scenario to continue coping with their jobs. The requirement to work from home during the current time is demonstrating to many that remote access technology can be effective and might even become part of many workers’ long-term routine. Being able to maintain some degree of team cohesion whilst working remotely is important; software tools that enable employees to collaborate more effectively might see an increase in use, as might video conferencing solutions.

Just like remote work, the pandemic situation is likely to accelerate adoption of technologies such as remote patient monitoring and healthcare IT within our Ageing & Lifestyle theme. Hospitals are facing an increasing number of patients and need to provide treatments for everyone. We’ve recently seen demand surge for monitors and sensors due to COVID-19. Technologies including wearable wireless sensors combined with software modules are allowing remote monitoring and clinician notification systems. This enables less physical contact with patients, thus preserving the status of quarantine. Another benefit is to separate patients more efficiently: from monitoring and observing mild cases (even sending them home with cloud software access) to providing the most severe cases with beds in wards designed for more thorough treatment. Such remote technology will be a game-changing in light of the crushing demand on hospitals during the COVID-19 pandemic. Newly installed monitors are likely to stay in place, and we are also seeing development of software that will enable use with existing monitors to strengthen the remote monitoring offer. People’s view on health and treatment will somewhat change in a post COVID-19 world, with more acceptance of new technologies, contributing to improving life expectancy and positioning our Ageing & Lifestyle companies at the forefront.

We believe that one other legacy of COVID-19 will be the disruption of global supply chains within our Automation theme. This will force companies to rethink their manufacturing footprints and their sourcing of crucial components. While it will take a huge amount of time to reconfigure global supply chains, we believe that marginal investments may well return to the US and Europe as a result of these issues, as well as the fact that the cost advantages of outsourcing manufacturing to developing nations continues to diminish each year. While we are not forecasting wholesale changes, incremental investments in connected smart factories will come with a higher degree of robotics and automation technology, which we believe should provide a long-term support to this theme.

While a post-COVID-19 world will encompass higher unemployment globally, one of the easiest ways for governments to support job creation is spend and fiscal boost into the infrastructure industry. Within our CleanTech theme, we expect renewables projects are likely to benefit from this stimulus with government promoting the shift towards a lower carbon economy. There is some early speculation that this could also be focused on Electrical Vehicle (EV) infrastructure. In China, subsidies for EV have been extended by two years which we expect to support the ongoing transition to new energy vehicles in a market which represents more than half of global electric vehicle sales1 . Whilst EV support is lagging in the US, we believe the shift will eventually be driven by the product offering rather than regulation.

During lockdown periods, populations within Transitioning Societies are somewhat forced to adopt new ways of consuming products and services. People may like what they’ve tried and this phenomenon may accelerate the development and spending on areas such as online education; healthcare access – with millions of video medical consultations proceeding as result of the virus update; or financial planning – with companies offering suitable planning solutions and persuading their customers to invest in them through digital channels. Once the current turmoil is over, the Emerging Middle class will still want to consume, and we have even started to see encouraging signs in China with global brands reopening their local businesses.

The strength of investing in the Evolving Economy is that these companies remain firmly anchored to long-term trends rather than relying on short-term events. Whether it be a binary outcome - such as a presidential election - or the type of brutal market volatility we have experienced in the pandemic situation, the long-term drivers supporting our identified themes are unaltered and the opportunities by investing actively could even play out stronger. The global population is irreversibly ageing, the Emerging Middle class still growing at sustained pace, while the continuous advances in technology keep facilitating online consumption, supporting the energy transition and making factories more automated.

Connected Consumer theme

From 2020 to 2025, the global remote access software market is expected to grow at a CAGR2 of c.16%3

TeamViewer, German remote software

TeamViewer is a German software company which specialises in secured remote access for the monitoring and management of commercial and industrial appliances. The software encompasses various digital channels including remote control, desktop sharing, online meetings, web conferencing and file transfer between computers. TeamViewer software allows companies to provide support for their customers remotely or enabling their own staff to be as effective as possible at doing their own tasks despite a “Work from Home” situation.

Ageing & Lifestyle theme

Installation of continuous postoperative monitoring is reducing rescue events by 60%4

Masimo, US Patient Monitoring

Masimo is a US company which supplies a range of non-invasive monitoring solutions that can help care teams prepare for and manage an influx of patients quickly and efficiently. The company also provides advanced home monitoring solutions which ensure continuous health control from distance whilst providing notification to hospitals.

Masimo is also integrating its technology towards multi-parameters monitors and devices from leading brands.

Automation theme

Machine vision systems process huge amounts of information within a few seconds to make factories and manufacturing centers more efficient. Machine vision continues to proliferate and its market size is expected to reach USD 18bn by 20255

Keyence, Japanese sensors and measuring equipment

Keyence develops, manufactures and sells sensors and measuring instruments used for Factory Automation (FA) and high technology hobby products. The company’s products include laser scan, bar code readers and fiber optic sensors. Keyence is being seen in an increasing number of end markets including auto, electronics, logistics and robotics.

CleanTech theme

With attractive economics and supportive policy, cumulative wind and solar capacity globally is set to rise from c.1 Terawatt6 in 2018 to 4 Terawatts by 20307

Orsted, Danish Offshore wind turbine

Orsted is a leading company in offshore wind turbine with several wind farms in the North Sea. The company develops new floating foundation systems which makes installation possible in multiple numbers of untapped locations worldwide, significantly increasing the production capability. The company operates the Block Island in the US which was the first offshore wind farm in the country. It has been since awarded a number of other future developments.

Transitioning Societies theme

Indian Healthcare services is a highly underpenetrated market with healthcare spend at <4%8 GDP9 (vs. 17% in US and >5% in China)

Dr Lal PathLabs, Indian diagnostic and related health care tests

Dr Lal PathLabs is the #1 branded diagnostics chain in India, operating for over 70 years in the industry. The established company encompasses c.50 million tests per annum a with a Pan-India integrated coverage. Its customers base includes individual patients, corporates & institutions, healthcare providers as well as hospital and clinical labs (lab management). Dr Lal is well-positioned in one of the fastest-growing segments of the Indian healthcare industry and has a scalable model integrated through centralised IT platform for a network expansion.

- SW50ZXJuYXRpb25hbCBFbmVyZ3kgQWdlbmN5IC0gR2xvYmFsIEVWIE91dGxvb2sgMjAxOQ==

- Q0FHUiAtIENvbXBvdW5kIEFubnVhbCBHcm93dGggUmF0ZQ==

- UmVtb3RlIEFjY2VzcyBTb2Z0d2FyZSBNYXJrZXQsIEtub3dsZWRnZSBTb3VyY2luZyBJbnRlbGxpZ2VuY2UgTExQLCAyMDE5

- TWNHcmF0aCBTUC4gVGhlIEpvaW50IENvbW1pc3Npb24gSm91cm5hbCBvbiBRdWFsaXR5IGFuZCBQYXRpZW50IFNhZmV0eS4gMjAxNiBKdWw7IDQyKDcpOjI5My0zMDIu

- Qmxvb21iZXJnIHByZXNzLXJlbGVhc2UsIEdyYW5kIFZpZXcgUmVzZWFyY2ggcmVwb3J0LCBNYXkgMjAxOS4=

- T25lIFRlcmF3YXR0IGlzIGVxdWFsIHRvIG9uZSB0cmlsbGlvbiBXYXR0cy4=

- Qm9mQSBNZXJyaWxsIEx5bmNoLCBHbG9iYWwgQ2xpbWF0ZSBDaGFuZ2UgUHJpbWVyLCBKYW51YXJ5IDIwMjAuIFN0b2NrIHNob3duIGZvciBpbGx1c3RyYXRpdmUgcHVycG9zZXMgb25seSBhbmQgc2hvdWxkIG5vdCBiZSBjb25zaWRlcmVkIGFzIGFkdmljZSBvciBhIHJlY29tbWVuZGF0aW9u

- U291cmNlOiBXb3JsZCBIZWFsdGggT3JnYW5pemF0aW9uIEdsb2JhbCBIZWFsdGggRXhwZW5kaXR1cmUgZGF0YWJhc2UsIE9jdG9iZXIgMjAxNw==

- R0RQIC0gR3Jvc3MgRG9tZXN0aWMgUHJvZHVjdA==

Not for Retail distribution

This document is intended exclusively for Professional, Institutional, Qualified or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document. Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.