Why inflation linked bonds are a good way to add duration

- 11 April 2023 (5 min read)

Inflation has been slowing

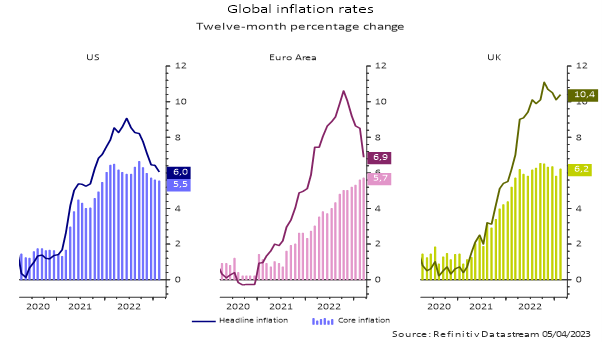

After inflation reached a 4-decade high in 2022 in the USA, the UK and the € Area, the disinflation process has started. Headline inflation (which includes the prices of food and energy), has been moving lower at a rather steady pace. As an illustration, inflation in the € Area has been estimated to be 6.9% over the past 12 months in March, down from 10.6% back in late 2022. There is a catch, the main reason why inflation has been moving lower, is what is called a base effect: prices are not falling but the pace of price increases is a bit slower than at the same time a year ago… nothing to cheer for policymakers.

Core inflation remains a hot spot

Slowing overall inflation may look like a good piece of news but unfortunately, it’s not enough as core inflation remains too high. Core inflation (which excludes the prices of food and energy) is deemed to be a better indicator of domestically generated inflation as it focuses on goods and services prices.

This underlying measure of inflation remains close to its highest point of the cycle in the UK and has not stopped accelerating in the € Area. It had slowed in the US because of lower goods prices, as Covid-related inflation has vanished, but the prices of services (especially excluding housing, which has become a key indicator for the Federal Reserve) stands at 5.5%, marginally down from 6.6% back in September 2022.

Source: AXA IM, Datastream as at 05/04/2023

Market expectations of future inflation are benign

Despite inflation being stubbornly high, economists expect a sharp slowdown of inflation over 2023. The consensus is that US inflation should reach 3%, only slightly above the Federal Reserve target of 2% by the end of the summer. In the Euro Area, economists expect inflation to reach close to 3% only around the end of 2023.

It is not only economists who expect inflation to be quick to return to more acceptable levels; markets are pricing a similar scenario. Inflation breakevens (which reflect the average annual inflation priced into inflation linked bonds) show that in the US inflation is expected to average 2.4% per year over the next decade, only a touch lower than what is seen in the Euro Area at 2.6%.

Source: AXA IM, Datastream as at 05/04/2023

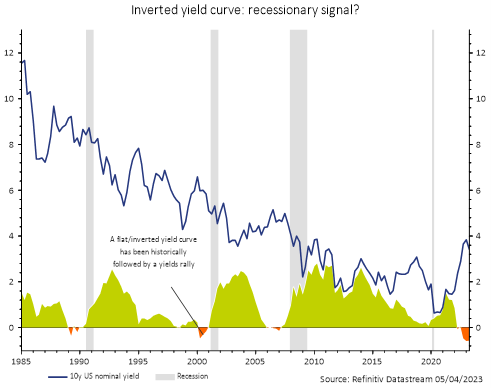

The bond market is signaling tight monetary conditions which may signal that now is a good time to add duration

As banks tend to borrow over the short term to lend over longer horizons, an inverted yield curve has generally been associated with slower credit growth and as a result, has become a key indicator of when interest rates reach their peak. The recent banking sector turbulence, coupled to the inversion of the US Treasuries curve since November last year, is likely to trigger a pause in the Federal Reserve’s rate hikes before summer. Such a pause has also historically been a bullish duration signal.

Source: AXA IM, Datastream and Bloomberg as at 05/04/2023

Inflation linked bonds appear to us as the most appropriate way to add duration to portfolios

While we believe that now is the right time to start adding duration to portfolios as a strategy for the economic cycle, we see a risk that inflation stays elevated and therefore believe that it’s best to implement long duration positions through inflation linked bonds.

As inflation linked bonds are issued by sovereigns, they tend to be liquid and highly rated. On top of this, the tightening of monetary policy over the past 18 months has brought inflation linked bonds yields (also called real yields which is the premium earned by investors on top of future inflation) at their highest level since 2009-2010 depending on the maturities.

Considering that inflation breakevens are inexpensive as the market is only putting a small premium on future inflation over Central Banks targets, we see a compelling risk / reward in the inflation linked bonds market.

Source: AXA IM, Bloomberg as at 05/04/2023 for illustrative purposes only. Developments of the past offer no guarantee and are no indicator for any future returns or trends.

We believe that with real yields now in significantly positive territory and inflation breakevens pricing a benign inflation outlook, it is creating an attractive opportunity for inflation linked bonds.

Therefore, adding duration through US, UK and € Area inflation linked bonds of short and intermediate maturities seems attractive. The current environment also lends itself to flexibile approaches that move between nominal and inflation-linked bonds.

It will take time for the recent rate hikes to be reflected in the economy, so we expect inflation indexation to be high until summer (3%+ in € terms non annualised). This should generate attractive inflation income opportunities.

Fixed Income

We cover a broad spectrum of fixed income strategies to help investors build diverse portfolios that can be more resilient to economic and market shifts.

Find out moreDisclaimer

This document / video is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.