Robotech strategy - February 2023

- 23 March 2023 (5 min read)

Apart from the US, we also see initiatives of reshoring and localised production in Europe and certain Asian countries

- China’s manufacturing activity is expanding at the fastest pace in since 2012

- Good performance from semiconductor and simulation software holdings

- We took profits on semiconductor and reallocated the proceed to some MedTech companies

What’s happening?

Equity markets fell during February following a positive start to the year in January. After a challenging 2022, the Robotech strategy continued its strong start to the year outperforming the broader market. We saw good performance from some of our semiconductor holdings as they reported encouraging results and a number of our software companies, particularly in the simulation space performed well.

Company earnings season has generally been good for the holdings in the strategy, with a constructive tone set for 2023 outlooks despite some of the macroeconomic challenges. The theme of reshoring and localised production continues to be broadly discussed by companies as a potential to drive meaningful investments in the robotics and automation industry. Whilst this is often talked about principally happening in the US, it’s important to note that there are similar initiatives in Europe and certain Asian countries. Indeed, the International Federation of Robotics (IFR), a specialist research organisation that tracks trends in the industry recently published its annual review and increased their estimates for global industrial robotics sales by over 25%1 for shipments in 2023 and 2024.

The recently announced reopening of China adds a new dynamic for the market with potential for investments and CAPEX2 to increase post the Chinese New Year holiday following a long period of uncertainty in the region. On the 1st March, Chinese Purchasing Managers Index (PMI) data was released, which was significantly better than expected suggesting that China’s manufacturing activity was expanding at the fastest pace in since 2012. Whilst it’s too early to draw firm conclusions about this trend, it’s an encouraging data point that industrial activity is accelerating after a challenging COVID period.

Portfolio positioning and performance

In In February, we saw good results from our semiconductor holdings with 2023 outlooks remaining robust. Semiconductors were generally weak in 2022 on concerns of an economic slowdown and weakness in consumer end markets like PC and Smartphone. Our investments are typically more focused on the end markets of Automotive, Industrial and Data Centre where demand has been more resilient. Earnings results from Silicon Labs (Internet of Things chips), On Semiconductor (Automotive and Industrial chips) and Nvidia (GPUs for Data Centre, Gaming and Artificial Intelligence) were the standouts with the share prices performing strongly as a result.

Industrial software was generally good, with strong results from Altair and Ansys, two US companies focused on software used for simulation and Cadence a US Software company focused on software for semiconductor design. Revenues for these companies are typically linked towards their customers R&D3 budgets and new product innovation which appears to be remaining robust. We saw softer results from Autodesk a design software company with more exposure to the construction market.

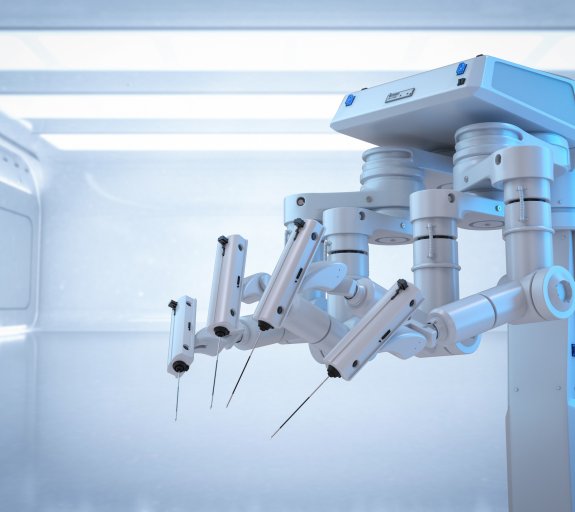

The share price for Globus Medical, a US MedTech company which has developed a spinal surgery robot, was weaker as they announced a deal to acquire one of their competitors, Nuvasive – the deal caught investors by surprise and we await further clarity on the proposed benefits of the transaction. Cognex, a US company focused on machine vision used for factory and warehouse automation was weaker as they reported softer business conditions. Cognex results are often sensitive to the CAPEX decisions of larger customers such as Apple and Amazon and it appears that there is still uncertainty in demand whilst Amazon digests the large warehouse expansion that they underwent during the pandemic.

We exited our holding in Nidec, a Japanese company focused on small precision motors. The company is undergoing a period of uncertainly with leadership changes and some restructuring so we see better opportunities elsewhere. We used some of the proceeds of this sale to continue to build up our position in Japanese Industrial company Mitsubishi Electric where we initiated a position last September.

With our semiconductor holdings performing well, we used this as an opportunity to trim Nvidia and ON Semiconductor. Investor excitement has grown around the concept of ChatGPT and Artificial Intelligence applications which are using GPUs4 from Nvidia. We believe that this is an interesting opportunity as Artificial Intelligence applications and use cases continue to develop. However, since we had previously added to our position in Nvidia in December, we thought it prudent to take some profits in February with the stock rising 59% in the first 2 months of the year.

We added to our position in Kion, a Germany company focused on warehouse automation solutions. Kion has struggled over the last couple of years due to supply chain disruptions and higher inflation impacting the profitability of its contracts – the new management team at Kion are implementing new agreements with customers with inflation clauses in them which should help the predictability of business profitability going forward.

With the market rotating back in to some more growth focused names so far in 2023, our healthcare positions have generally underperformed the rest of the portfolio. We have used this as an opportunity to reinvest the proceeds of our reductions in our semiconductor holdings to reallocate to some MedTech companies - Intuitive Surgical (Robotics Surgery) and Axonics (Sacral Neuromodulation).

Outlook

The US is trying to reinvigorate its domestic manufacturing via infrastructure spend and capital expenditures (CAPEX). This is important politically as its US Jobs, important geopolitically as it keeps US intellectual property within the US and important for supply chain as its secure stock within the country after the disruption witnessed post-COVID. Government support has evolved over the past few years, whether it be the Trump Administration – with tariffs in the US China trade war – or more recently with the Biden administration and the CHIPS Act signed to ramp up and ‘reshore’ US technology such as domestic semiconductor manufacturing. US president Biden also passed the Inflation Reduction Act (IRA) allocating a lot of spend for more domestic US manufacturing, focussed on key technologies. As a result of tariffs, incentives and reducing the risk of supply chain issues, companies are investing again in the US and this comes with technological sophistication, robotics and automation.

Whilst being optimistic on demand from the US and the reshoring trends, it is also encouraging to note the recent reopening of China. Whilst the pace of reopening and the timings of associated CAPEX are less easy to forecast, stronger demand for automation technologies from the region would be welcome. Many of the companies held in the strategy are global in nature and could benefit from demand for an increase in robotics equipment wherever growth comes from in the world.

The labour market continues to be tight in many areas where continued labour shortages present a real challenge for businesses. For instance, in the manufacturing space or warehousing space, we see fewer workers – particularly younger demographics – that are willing to do these kinds of jobs, given the nature of the roles and the salary. As a result – facing labour inflation and labour shortages – companies are increasingly incorporating Technology and Automation in their processes to increase efficiency and productivity with their existing/shrinking workforce. In simple terms, we anticipate that labour shortages and wage inflation are substantial drivers of automation demand over the next few years. As labour costs go up, the payback periods become quicker from introducing automation, meaning that more and more areas are considered for automation.

There has been a valuation reset in the market broadly – particularly led by growth-related names – and we now see valuations of our Robotech strategy around the cheapest they have been since the COVID pandemic. Long Term annual earnings growth has ticked down with supply chain challenges, inflationary pressures and rising raw material costs, but continues to be healthy. In times of economic slowdown, scarcity of growth should support valuations of companies maintaining higher EPS growth and stable margins. Although we want to be prudently cautious looking in to 2023, corporate earnings have so far been pretty resilient for our Robotech strategy and the fundamental long-term underlying trends remain the same, suggesting, valuation-wise, an interesting opportunity for growth investors.

As investors we aim to focus on identifying well managed businesses, with proven operating models and large opportunities ahead of them and believe that this is the right approach to investing in the long-term growth opportunities present within robotics and Automation.

No assurance can be given that the Robotech Strategy will be successful. Investors can lose some or all of their capital invested. The Robotech strategy is subject to risks including; Equity; Emerging markets; Investments in specific sectors or asset classes; Global investments; Investments in small and/or micro capitalisation universe; ESG.

- U291cmNlJm5ic3A7OiBJbnRlcm5hdGlvbmFsIEZlZGVyYXRpb24gb2YgUm9ib3RpY3MgKElGUiksIDIwMjI=

- Q0FQRVgmbmJzcDs6IENhcGl0YWwgRXhwZW5kaXR1cmVz

- UiZhbXA7RCZuYnNwOzogUmVzZWFyY2ggYW5kIERldmVsb3BtZW50

- R1BVcyZuYnNwOzogR3JhcGhpY3MgUHJvY2Vzc2luZyBVbml0cw==

Automation

Investing in automation and robotics - How are companies capitalising on robotics – and what does this mean for investors?

Find out moreVisit the fund centre

The Sub-Fund seeks to provide long-term capital growth, measured in USD, from a portfolio of listed equity and equity related securities, in line with a socially responsible investment (SRI) approach.

View fundsDisclaimer

Not for Retail distribution: This document is intended exclusively for Professional, Institutional, Qualified or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

Past performance is not a guide to current or future performance, and any performance or return data displayed does not take into account commissions and costs incurred when issuing or redeeming units. The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested. Exchange-rate fluctuations may also affect the value of their investment. Due to this and the initial charge that is usually made, an investment is not usually suitable as a short term holding.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. The strategies discussed in this document may not be available in your jurisdiction.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Please note that the management company reserves the right, at any time, to no longer market the product(s) mentioned in this communication in a European Union country by notification to its authority of supervision in accordance with European passport rules. In the event of dissatisfaction with the products or services, you have the right to make a complaint either with the marketer or directly with the management company (more information on our complaints policy available in English here). You also have the right to take legal or extra-judicial action at any time if you reside in one of the countries of the European Union. The European online dispute resolution platform allows you to enter a complaint form (by clicking here) and informs you, depending on your jurisdiction, about your means of redress (by clicking here).

Issued in the U.K. by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.