Fund Manager update – UK Equity Income

- 23 February 2022 (3 min read)

AXA Framlington UK Equity Income Fund

Simon Young, Portfolio Manager of AXA Framlington UK Equity Income Fund, pens his thoughts on why interest rates matter, Value vs Growth, and why volatility doesn’t equal risk.

Investors reading this report will wonder why the UK Equity Income Fund underperformed by just under 3% against the FTSE 350 Index (total return), that was almost unchanged in January. Thankfully we did not have any outsized profits warnings. Rather the answer lies in the pronounced stock and sector rotation that occurred during the month. Rising interest rates, with the market now forecasting further base rate rises sooner and with a higher peak, impacted ‘growth’ and benefitted ‘value’ stocks. In addition, consumer discretionary companies suffered as concerns mounted that higher inflation will erode household spending on non-essentials.

Value vs Growth

As inflation has gathered momentum and hastened the end of Quantitative Easing, we have seen the 30 year gilt yield rise from 1.1% at the end of 2021 to 1.4% at the end of January. This may not seem like a huge move but it has been part of the reason that ‘growth’ companies did so poorly in January. Nowhere is this better exemplified than in the relative divergence of the technology (growth) and tobacco (value) sectors. The FTSE All Share Technology sector fell over 12% in January, while the FTSE All Share Tobacco sector rose 14%. A near 30% differential between two sectors in one month is dramatic, especially when one considers that the fundamentals are unlikely to have changed much. The chart below shows their moves over the last year starting from a base of 100.

Source: Bloomberg, 15/02/21

To give some context to these moves it is worth looking at why long-term interest rates matter.

The theoretical value of a company is the sum of its future cashflows discounted back to today. Rising long term interest rates matter because they increase the rate at which the market discounts a company’s future cashflows. The higher the discount rate, the lower the value of those future cashflows in today’s money. ‘Growth’ companies, whose stream of cash flows are expected to grow fast into the future but whose cashflows today are relatively smaller, are more impacted by rising long term interest rates. This is because a greater proportion of their cashflows are in the future.

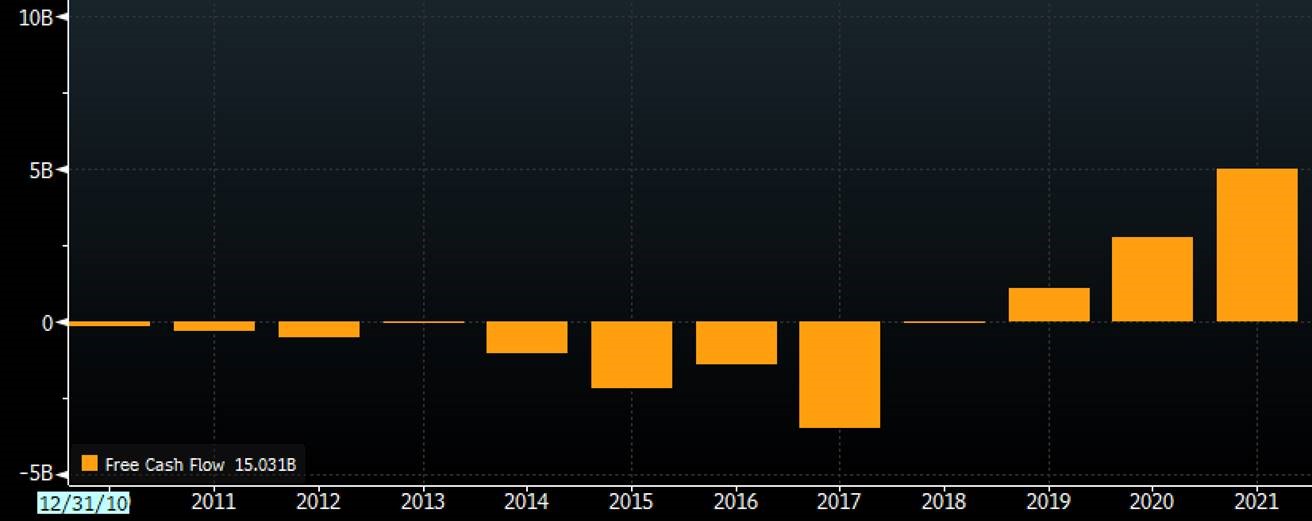

Tesla (not held) is a well-known example of a growth stock. The demand for Tesla’s electric vehicles has been phenomenal over the last 10 years. Revenues have grown exponentially and business has moved from losses into profits. At the end of December 2021, Tesla’s market capitalisation stood just north of $1 trillion ($1,000,000,000,000) while it generated free-cashflow of $5bn in 2021. For Tesla to justify its $1 trillion market capitalisation, the $5bn free-cashflow declared in 2021 needs to keep growing both fast and for a prolonged period into the future*. Given the growth needed in cashflows over many years, a small increase in the discount rate can have a disproportionate impact on the present value of those cashflows.

Tesla’s Free cashflow

Source: Bloomberg

Conversely ‘value’ stocks, whose cashflows are growing less fast but which generate more cash today as a proportion of their valuation, fair relatively better in a rising interest rate environment. As less of their valuation lies in the future, with more of the cashflows earned in the near term, so there is less to discount. Our holding in tobacco company Imperial Brands serves as an example here. The company is growing its profits much slower than Tesla, around 2-3% p.a., but is valued at a multiple of just 7x this year’s cashflows. An increase of 0.5% or even 1% in the long term discount rate really doesn’t significantly dent the present value of Imperial’s future cashflows. **

January’s moves between ‘growth’ and ‘value’ stocks created a great deal of volatility that may not be immediately apparent to an investor perusing the headline index returns. Within the FTSE 350, approximately 100 companies saw their share price decline over 10% during the month, yet the index return was almost flat at -0.2%. In the Fund we had 8 holdings down over 10% in January and 4 up over 10%.

The Fund is not a growth fund masquerading as an income fund, but we do have some positions with would be classed as growth companies. The Fund’s larger fallers in January such as Greggs (-20%), Games Workshop (-20%) and Sage (-14%) fall into this category, all with price earnings ratios over 20x. We hold these companies as we believe they have strong business models and generate attractive returns on capital employed. Importantly we believe they have produced good cashflows which we believe can be used to grow the business AND pay dividends (note the AND – we want growth AND income).

It is worth saying that the fundamentals for many companies have not changed hugely over the month, just the valuation investors apply to the company. In fact, analysts have been upgrading their profits estimates for our holdings in Sage and Greggs while Games Workshop’s H1 results in January showed that despite some freight related issues, the business continues to move forwards. On a relative basis we think some of the Fund’s low cost providers such as Greggs, Hilton Foods and Admiral Insurance will fare well as household budgets get squeezed by rising a sharply rising cost of living.

On the other side of the coin, the Fund’s underweights grew teeth and bit us during the month. Oil & Gas, Mining and Banks, where we have a low allocation due to their capital-intensive nature or patchy dividend track records, performed well. The Oil and Gas sector was also helped by a rising oil price spurred on by higher demand due to economic growth and geopolitical tensions on the Russia Ukraine border. A rising tide raises all boats and we will do well to stick to our investment process rather than chasing returns in hot sectors. Having said this, we did start a position in banking group Nat West. It is the largest commercial & business bank in the UK and has a good position in UK residential mortgages. Higher interest rates will benefit Nat West’s net interest income and we see the potential for write-backs of covid provisions that have not been utilised. Furthermore, the Group has excess capital over the minimum demanded by banking regulators to the tune of £7-8bn. Nat West intends to return this excess capital to shareholders via share buybacks or special dividends. Trading on less than 1x book value, we felt the risk reward looked attractive.

Volatility doesn’t equal risk

Volatility in itself isn’t necessarily a bad thing. It may be for a fund manager’s risk systems that equate volatility with risk, but we see risk in more absolute terms. We are more concerned with a permanent capital loss stemming from the erosion of company’s barriers to entry. Share prices of strong businesses tend to recover, the opposite is often true of poor businesses. So while the tracking error (risk) of the Fund will rise due to higher stock market volatility, we don’t think the risk associated to the underlying businesses has particularly changed.

It is often said that financial markets are driven by fear and greed, with share prices like pendulums, swinging from over-optimism to over-pessimism. We have used the pull back in shares prices to add to a number of existing positions such as Hilton Foods, Games Workshop and Rotork. We think the business prospects remain good and the valuation pendulum has swung back to more attractive levels. Realistically these companies may well get even cheaper over the next few months if inflation fears continue to grow, but these are proven businesses with good long term outlooks. To fund the purchases we reduced RELX, Diageo and AstraZeneca on valuation grounds and exited the remaining position in Advanced Medical Solutions.

*Source: Company reports / Bloomberg. We are not disputing Tesla’s valuation or growth rates, merely using it to illustrate an example of a growth company.

** Source: Tesla and Imperial Brands - Bloomberg 22/02/2022

Stocks are mentioned for illustrative purposes only and do not constitute investment advice or a recommendation

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.