Taking the plunge: Switching from saving to investing

- 06 September 2024 (5 min read)

KEY POINTS

With interest rates no longer languishing at their prolonged lows, the higher income available from cash savings means many individuals are perhaps considering why they would risk their money in the stock market.

But the prime driver for investing – as opposed to just saving – is the potential for far higher long-term financial returns.

Take the past five years, during which time there has been a global pandemic, war in Ukraine and a tricky economic backdrop that saw inflation and latterly interest rates soar.

But notwithstanding this backdrop, the S&P 500 index of the US’s biggest companies has risen by more than 86% over the period; a far higher return than any savings account could have delivered.1

Of course, past performance should never be taken as a guide to future returns – markets can fall as rapidly as they rise, but history has shown that over the long term, investing can potentially produce far superior returns than cash on deposit.

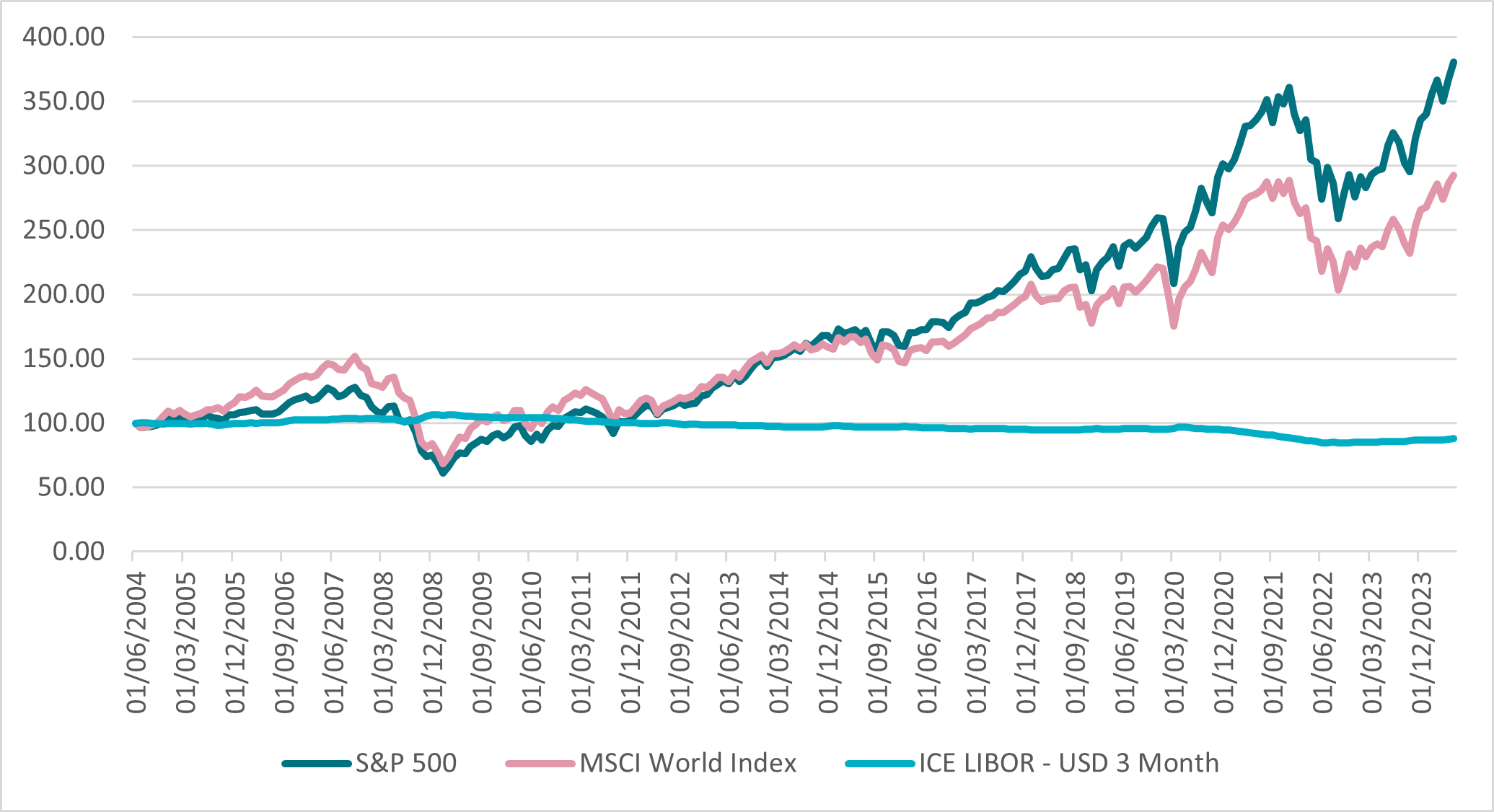

Take the past 20 years: a $100 investment in the S&P 500 - adjusted for inflation - would now be worth $381 (a 281% rise), or $293 if it had been invested in the MSCI World index, which tracks 1,429 companies across 23 countries. If it had remained in cash, it would be worth just $88.2

- R29vZ2xlIGZpbmFuY2UgYXMgYXQgMSBBdWd1c3QgMjAyNA==

- RmFjdFNldCwgVVMgZG9sbGFyIHRlcm1zIGFzIGF0IGVuZCBKdW5lIDIwMjQuIENhc2ggcmVwcmVzZW50ZWQgYnkgSUNFIExpYm9yIC0gVVNEIHRocmVlIG1vbnRo

Long-term investing: Markets vs. cash over 20 years

Source: FactSet, US dollar terms as at end June 2024. Cash represented by ICE Libor - USD three month

Having a cash buffer is still recommended. It makes sense to keep some powder dry for any unexpected expenses that come your way. Returns however are unlikely to be able to keep up with the pace of inflation, meaning that your spending power – the real value of your money – will be eroded over time.

What should first-time investors consider?

When it comes to investing thinking long term is key. You need to have a time horizon of at least five years but preferably far longer. The longer you can hold your investments, the greater the potential for returns.

While it can be daunting to invest when there is uncertainty in the markets, the earlier you start the longer you can give your investments to grow. Generally speaking, it’s best to avoid investing large lump sums in case of a sudden market fall. By investing affordable amounts regularly, it means you can take advantage of so-called pound-cost averaging, which can help you ride out bouts of market volatility, because your money will buy more assets when prices are low and less when prices are high.

Diversification is also paramount for long-term investing. And while it might be tempting to ease your way in by investing in a single stock, it is a high-risk strategy – you should spread out your risk, and never keep all your eggs in one basket.

For fledgling investors, there are two core asset classes to consider – equities and bonds. We briefly outline each below:

- Equities: When you buy equities - sometimes called ‘shares’ or ‘stocks’ - you are buying a share of a business. If it does well, your stake will rise in value – of course the opposite is also true. If a company fails to succeed, then there will be no profits, and its shares are likely to fall in value and could even become worthless. Some firms also share their profits with their investors via 'dividends'. This is one of the most important benefits of owning a share – in the long term, dividend payments could make a big difference to your return, especially if you reinvest them.

- Bonds: Governments or companies issue bonds when they want to raise money. While bonds come in a variety of guises, and risk levels, essentially, they are ‘IOUs’, with a fixed term and regular interest payments at a rate set when the bond is issued (these payments are often called the coupon). When the term ends the issuer repays the original loan – the principal – to the bondholder. While bonds are usually seen as less volatile than shares, they still carry risk. The issuer for example could get into financial difficulty and default on its payments – or go out of business altogether and investors may not get back their original investment. Additionally, bonds are very influenced by interest rates - when the cost of borrowing drops, the coupon on offer becomes far more appealing and bond prices rise and vice versa when interest rates rise.

Ideally new investors should consider a diversified portfolio of bonds, equities and possibly some other assets – as well as cash - depending on risk appetite and time horizon. The easiest way of ensuring diversification is to invest through a fund, where your money is pooled with other investors’ cash, which is then invested in a wide variety of companies.

Investing in a fund

Investing through a fund is a simple way to invest in many different companies and assets. When you invest your money through a fund, you are pooling your money with other investors. The fund is managed by a professional fund manager, who devises an investment strategy and buys shares and other assets in line with the fund’s investment objective (e.g., income or growth) and their view of the markets.

Funds make it easy to mix shares in different companies, bonds and other asset types. This reduces the impact of one investment doing poorly on the overall value of your investment.

Multi-asset and multi-manager funds typically invest across a very wide spread of asset classes, and even other funds, in order to diversify risk. As well as other funds these portfolios can invest in individual shares, bonds, and more alternative assets such as property, as well as commodities including gold.

Ultimately if you decide to invest, the two main factors to consider are your risk appetite and time horizon - and certainly in terms of the latter point, thinking long-term is best. While there is no cast-iron guarantee of investing success, by holding your savings in cash, they are only ever likely to experience lacklustre long-term growth.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments , products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.