Multi-Asset Investments Views: Out of Breath for Lack of Breadth

- 28 June 2024 (7 min read)

KEY POINTS

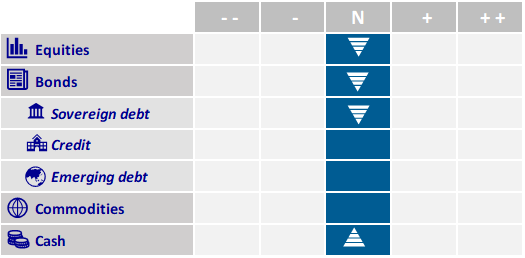

Our views

At a financial industry conference in late April, our answer to a question on the impact of the European Parliament elections was that it was “very important for Europeans, not at all for financial markets”. The past couple of weeks have been a lesson in humility. Whilst there were some surprises in the outcomes in some European Union member states (e.g. Greens in Germany, far-right in France), the heterogeneity of these surprises saw the new composition of the European Parliament ending up very much in line with projections from polls. However, one election can hide another, and the true surprise came from the local consequences of these continent-wide elections.

The ensuing market impact was rational, especially after a relatively strong risk-on start of the year: French government bond (OAT) to German government bond (Bund) spreads widened to a level last seen in 2017 when uncertainty prevailed over the two candidates qualifying for the French Presidential run-off, and related assets suffered accordingly (especially French banks). We therefore chose to reduce our exposure in both areas until we have more clarity on policy going forward and/or until market prices include enough stress premium to warrant the risk exposure.

French politics fortunately do not drive global financial markets. However, we trimmed our overweight developed equities to return to the long-term SAA exposure in our portfolios. We are not flagging a significant change in the fundamental, macroeconomic backdrop: the US GDP Nowcasting model from the Atlanta Federal Reserve (Fed) is running above +3% growth annualised, US job creations remain solid, and the latest US inflation reading was an encouraging soft surprise.

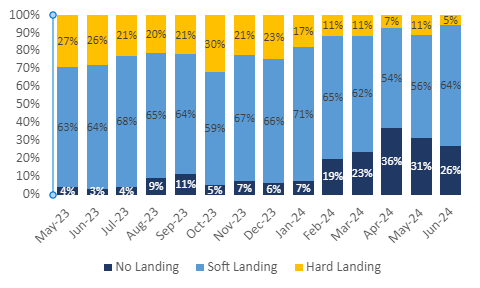

Our increased cautiousness stems from massive upwards revisions in growth expectations, whether for global and US GDP or for corporates’ earnings. At the start of the year, economists and strategists were debating between a soft, hard or no landing. Today, almost 90% of economists expect a soft landing according to a mid-June Bloomberg survey. The breadth of consensus forecast changes for the GDP growth of major global economies shot up to an all-time high in June. Growth forecasts have been revised up everywhere, leaving no space for upside surprise. Similarly, equity analysts substantially upgraded their forecasts and now expect earnings to grow strongly in the coming quarters. Basically, the Goldilocks narrative has become highly consensual (see chart below) and is now at risk of any negative surprise.

Other elements informing our more tactical prudent allocation include the optimistic to even slightly stretched investor sentiment and positioning. Meanwhile, the softening trend in the implied rate for bond volatility (e.g. visible in the Merrill Lynch Option Volatility Estimate index), which we had flagged in our May MAI Views as supportive to equity multiple expansion, recently bounced higher, whilst equity multiples have kept on expanding. In our view, this gap between rates volatility and equity multiples raises concerns for near-term market fragility.

Within our equity allocation, we also take a more defensive tilt, stepping back from our previous conviction of a broadening in the equity market rally. In particular, whilst French politics have not particularly hurt European small and mid-caps, disappointing soft data in economic surveys has reduced our short-term enthusiasm. Concentration is now extreme and this lack of breadth is unlikely to be conducive to a catch-up for weaker, higher-beta parts of the equity market.

We have also taken some profit on government bonds by reducing interest-rate sensitivity (aka duration). AXA IM’s macroeconomic view remains that some US labour market softness and modest disinflation will allow the Fed to start cutting its interest rates in September. This scenario, broadly reflected in market expectations, is however a close call, at risk of yet another delay in monetary easing in case of an upside surprise in the US consumer price index (as was the case mid-May) or in non-farm payrolls (as per early June). This fundamental assessment is corroborated by our quantitative signals, driven in part by the recent bounce in oil prices, back above $80 for Brent. We therefore consider the asymmetry of risks no longer favourable enough: we fade the rally in developed government bonds and revert to our long-term duration exposure.

Soft landing most likely outcome in line with our view: How market consensus evolved between ‘soft’, ‘hard’ and ‘no’ landing

Source: BofA Fund Manager Survey, BofA Global Research

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2024 AXA Investment Managers. All rights reserved

Image source: Getty Images

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.