What impact could robotic surgery have on the future of healthcare?

Key points

- Technological advancements have seen the application of surgical robots broaden over time to include general surgery and delicate operations

- Only 4% of surgery globally is done with robots, with most of these procedures performed in the US

- We believe the applications in robotic surgery will continue to widen by both procedure type and region, creating compelling investment opportunities

Surgical robots have been around since the 1980s, with the Puma 560 used in 1985 by Kwoh et al to perform neurosurgical biopsies and non-laparoscopic surgery with greater precision.1

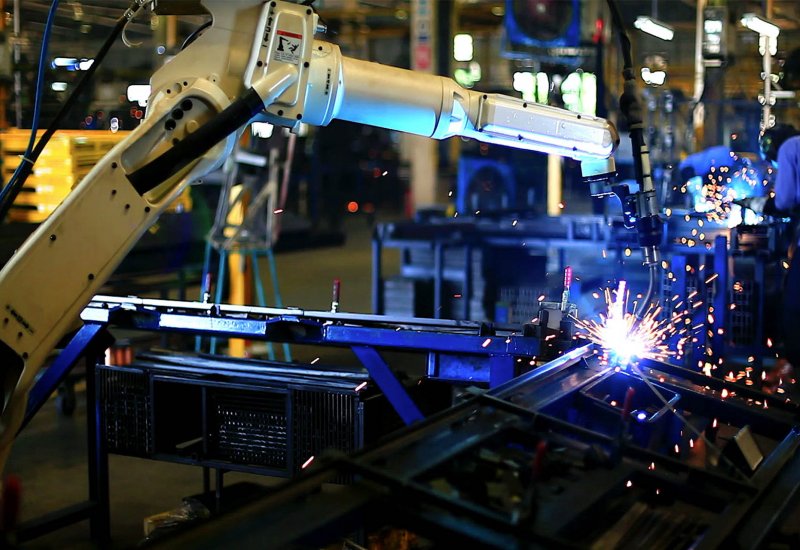

As technology and surgical developments have rapidly advanced over the years, so too has the general perception of robots – moving from science fiction to cutting-edge technology that could ultimately revolutionise healthcare.

More than 30 years later, the influence of surgical robots in operating rooms is growing at pace. Only 4% of surgery globally is done with robots2, with most of these procedures performed in the US. While this figure may currently sound small, we believe this highlights the huge growth potential for geographic expansion in the coming years.

The benefits of robotic surgery include:

- Enhanced dexterity: Surgeons are able to operate in very tight spaces in a body that would otherwise only be accessible through open surgery;

- Greater precision and control: Surgical robots help surgeons with the positioning and manipulation of surgical instruments;

- Shorter hospital stays: The smaller incisions will likely mean faster recovery times for patients and, generally, lower readmission rates.

Examples of procedures fueling innovation in robotic surgery

Over time, the application of surgical robots has significantly widened - from general laparoscopic procedures such as hernia and colorectal surgery to delicate operations on the heart and spine, knee replacements and removing brain tumours. Below are some examples of companies leading innovation in robotic surgery:

General surgery

At the forefront of the developments in these types of procedures is Intuitive Surgical*, which manufactures robotic-assisted medical equipment to support doctors and hospitals in minimally invasive surgery. It pioneered the groundbreaking da Vinci system, with almost 6,000 in existence around the world and a surgeon starting a da Vinci procedure every 25.4 seconds. In 2020, da Vinci Surgical Systems were used to perform 1.2mn procedures, a marginal increase from 2019 – and a significant figure, given that some surgeries had been postponed due to the COVID-19 pandemic.

Launched in 1998, Intuitive Surgical’s da Vinci system was one of the first robotic-assisted systems approved by the US Food and Drug Administration (FDA) for general laparoscopic surgery. Intuitive’s status as a key player is backed up by a comprehensive training programme for academics and future doctors, and reinvestments in research and development – its annual spend on the latter has almost tripled from $197mn in 2015 to over $500mn in 2019 and 2020.

Spine surgery

Globus Medical* is a leading medical device manufacturer, focusing on musculoskeletal implants that provide spine care solutions for patients. One of its solutions is the ExcelsiusGPS, a robotic arm with complete navigation capabilities in one adaptable platform for accurate alignment in spine surgery. It means surgeons can visualise, plan and navigate patient anatomy – as well as receive navigation feedback throughout the procedure - in real-time. The company has also developed orthopaedic trauma solutions in recent years to diversify beyond the spine market.

Knee replacements

The global share of older people (60+) is expected to increase by 42% from 2018 to 2030 – five times faster than the under 60 population.3 As you age, knee joints run the risk of becoming worn or damaged over time, with knee replacement surgery generally carried out on the 60-80 age bracket.4 Many people also live more active lifestyles into older age, compared to previous generations. This means more people may find they need knee surgery in their later years.

Zimmer Biomet* is a US healthcare company that specialises in knee surgery. Its ROSA Knee robotic technology is designed to help a specially trained surgeon tailor the placement of knee implants. Zimmer has also developed its mymobility app, in collaboration with Apple, to inform care decisions and further enhance the communication between patients and their surgeons.

Huge growth potential around the world

The global market for robotic surgery equipment is expected to achieve a compound annual growth rate of 30% until 2023.5 The COVID-19 pandemic meant that hospitals around the world were forced to delay many non-urgent surgeries in which robots could have supported. However, going forward, the containment of the disease through the rollout of vaccines will likely normalise hospitals’ operational capacity, leading to a surge in postponed robotic surgeries being performed.

Another reason for optimism is likely to come in the form of new market entrants, with the low market penetration allowing different companies to develop solutions that address a range of issues. For example, Johnson & Johnson* has a growing market presence, particularly with its acquisition of Auris Health – a robotic technology platform focused on lung diagnostics and procedures. Elsewhere, Medtronic*, a global medical device manufacturer, is in the process of developing a surgical robot.

With new entrants comes the potential for more innovation, thanks to disruptive technology like image-guided robotic interventions and enhanced motion control for greater precision. Coupled with 5G and AI6, developments in these areas will likely increase the types of robotic-assisted surgical procedures performed in the future – for example, the removal of tumours from parts of the body that would otherwise be difficult to reach. As a result, we expect this will create compelling investment opportunities within robotic surgery over the coming years.

* All stocks mentioned are for illustrative purposes only and should not be considered as advice or a recommendation for an investment strategy. All company information can be found on their websites and is accurate as at 28 February 2021.

- YS Kwoh, J Hou, EA Jonckheere at al. A robot with improved absolute positioning accuracy for CT guided stereotactic brain surgery. IEEE Trans Biomed Eng 1988

- Bank of America Merrill Lynch, global research estimates, December 2020

- Bank of America Merrill Lynch Silver Dollar / Longevity Report, May 2016

- NHS UK, August 2019

- International Federation of Robotics 2020

- AI refers to artificial intelligence

What is automation?

Investing in automation and robotics - How are companies capitalising on robotics – and what does this mean for investors?

Explore AutomationVisit the fund centre

The strategy aims to generate long-term capital growth by investing in companies throughout the world active in the expanding field of robotics and robotics-related technologies.

View fundsNot for Retail distribution

This document is intended exclusively for Professional, Institutional, Qualified or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This promotional communication does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee that forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Before making an investment, investors should read the relevant Prospectus and the Key Investor Information Document / scheme documents, which provide full product details including investment charges and risks. The information contained herein is not a substitute for those documents or for professional external advice.

The products or strategies discussed in this document may not be registered nor available in your jurisdiction. Please check the countries of registration with the asset manager, or on the web site https://www.axa-im.com/en/registration-map, where a fund registration map is available. In particular units of the funds may not be offered, sold or delivered to U.S. Persons within the meaning of Regulation S of the U.S. Securities Act of 1933. The tax treatment relating to the holding, acquisition or disposal of shares or units in the fund depends on each investor’s tax status or treatment and may be subject to change. Any potential investor is strongly encouraged to seek advice from its own tax advisors.

Past performance is not a guide to current or future performance, and any performance or return data displayed does not take into account commissions and costs incurred when issuing or redeeming units. The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested. Exchange-rate fluctuations may also affect the value of their investment. Due to this and the initial charge that is usually made, an investment is not usually suitable as a short term holding.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.