Tech stocks: down but by no means out

- 23 November 2022 (7 min read)

Tech stocks have fallen more sharply than the broader market during 2022, but the secular trends driving growth remain in place

Key points:

- While tech indices have fallen by more than global equities in 2022, valuations relative to the broader market remain marginally above the long-term trend.

- We believe that earnings are a key metric in the sector – of the companies that have so far reported their third quarter results, 88% of our investments in the fund beat earnings expectations, compared to 64% in the tech sector and 62% in global equities.1

- With equity markets likely to remain volatile in the short-term, investors should not lose sight of the long-term trends that are driving growth in the tech sector for companies that can navigate these challenging times.

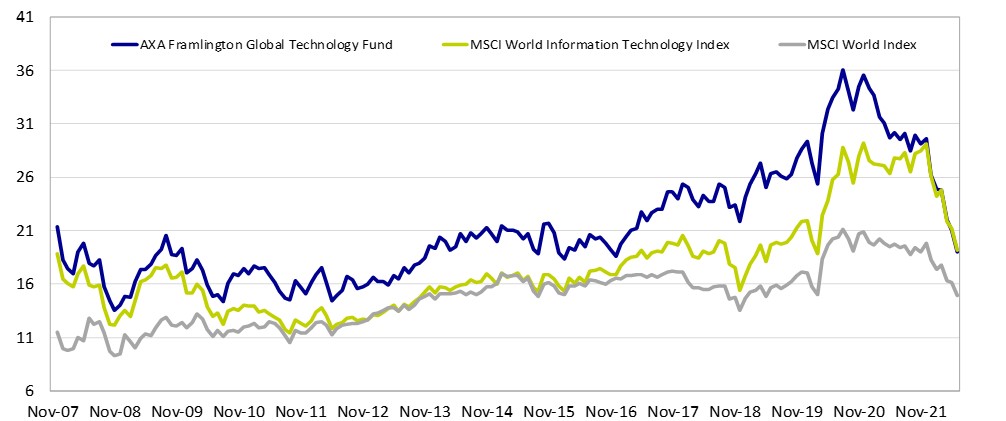

The last 12 months have been tough for equity investors and technology has fallen further from grace than the broader equity market, declining -16.7% since the start of the year compared to a -6.0% decrease in the global equity index.2 While these falls will doubtlessly make investors anxious, tech returns have been very healthy on the longer term: over the prior nine years, the global technology sector has outperformed general equities by an average of 10%.

Recent falls also obscure the fact that valuations remain robust compared to general equities. The gradual uplift in valuations that began in 2016 accelerated sharply during lockdown, when demand for the products and services provided by tech companies soared. In this context, the repricing this year can be seen as a realignment of market expectations back towards the longer-term average, rather than a more profound loss of faith in the sector.

Source: FactSet as at 30/06/2022. Chart updated on a quarterly basis, latest available. Past performance is not a guide to future performance.

Tech maybe down but it is definitely not out

Crucially, we believe that the long-term trends that are driving growth in the sector remain in place. Technology is driving change across the whole economy, and businesses, customers and governments are open to change, adopting new technologies faster than at any time in history.

Source: AXA-IM. For illustrative purposes only.

Technological innovation is at the heart of this, and these forces are driving a multi-year investment cycle. Recent consolidation within the sector is a clear sign that technology companies with strong business opportunities are attractive to strategic buyers.

Look at earnings, not valuations

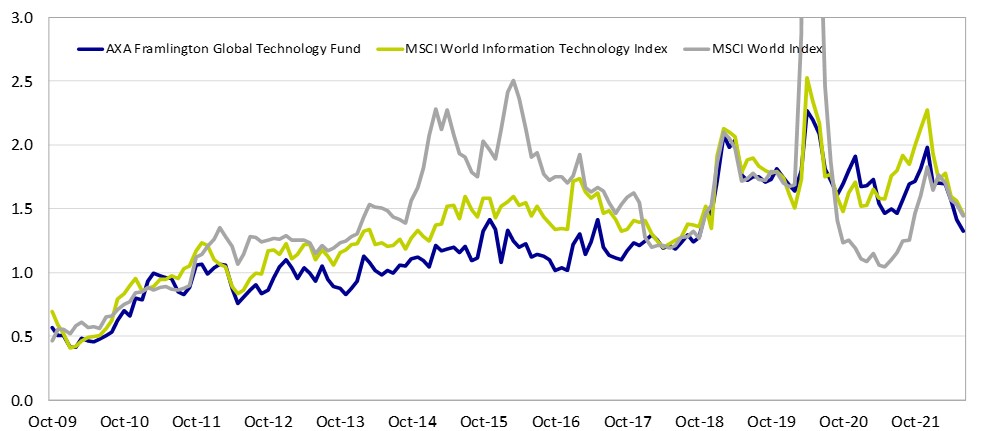

While valuations are important, they’re not the overwhelming driver of our stock selection. As the below chart shows, the AXA Framlington Global Tech Fund the fund has consistently shown higher price-earnings ratio than both the general market and, indeed, of the tech sector itself.

Price to Earnings 12m (Forward)

Source: AXA IM, Bloomberg. Descriptive data calculated using FactSet data, USD. Harmonic averages used for price ratios and weighted averages elsewhere. The interquartile method (based on the comparative benchmark) has been applied to ensure outliers do not distort the data. As at 30/06/2022, chart updated on a quarterly basis, latest available. Past performance is not a guide to future performance.

We think that this is a premium worth paying to get access to companies that are delivering good, consistent, compounding growth. The chart below shows that our portfolio is forecast to deliver higher earnings growth relative to valuations than both the sector and the overall market.

PEG Ratios (Post crisis)

Source: AXA IM, Bloomberg. Descriptive data calculated using FactSet data, USD. Harmonic averages used for price ratios and weighted averages elsewhere. The interquartile method (based on the comparative benchmark) has been applied to ensure outliers do not distort the data. As at 30/06/2022, chart updated on a quarterly basis, latest available. Past performance is not a guide to future performance.

We prefer companies with strong balance sheets, and this characteristic is particularly helpful in a market environment like this. Companies with their own cash reserve are better able to invest and develop new opportunities when the capital markets are closed to them, a lesson many learnt during the financial crisis.

This focus on growth has paid off, as recent earnings trends for the companies held in the fund have been significantly ahead of the market. 88% of the companies we hold beat earnings expectations in Q3 2022, compared to 62% in MSCI World Index and 64% in the technology component of the same index.3 This has helped the fund deliver returns of 3.5% over the third quarter of the year, compared to the benchmark 2.0%. 4

However, financial results have started to reflect the difficult macro-economic and geopolitical backdrop, with fewer companies exceeding revenue and earnings forecasts so far in the third quarter than in prior periods. Revenues are under pressure, but we draw some comfort from the fact that many of our investments continue to deliver better than expected earnings. This suggests that management teams are taking a constructive approach to managing costs and protecting their margins.

Incorporating market trends in a long-term view

We’re long-term investors and prefer to make changes only when we think a change is needed rather than chase short-term trends. As a result, the fund has a low turnover ratio of around 15%. However, we have continued to refine our portfolio based on the shifting global backdrop, economically and politically, and of course the impact of the pandemic.

As the lockdowns started to ease in 2021, we started to trim several companies that had done well during the period of the pandemic. These included names such as Zoom Digital, Atlassian, TeamViewer and Akamai.

Late into 2021, and in the early months of 2022, we started to notice cracks appearing in consumer confidence as inflation started rising. We therefore started to reduce our holdings in companies that relied on either selling directly to consumers – the Chinese online shopping platform Alibaba, for example – and those relying on consumer-centric advertising-based business models, such as Meta Platforms and Snap.

In more recent months, we have been reviewing the portfolio to make sure we’re happy with what we own and consider other opportunities. We sold the remainder of our investment in Zendesk following the bid proposed by a consortium of private equity firms to acquire the company. We sold our positions in Okta and Rapid7 as we consolidated our investments in cybersecurity, but we continue to like the space as a theme and we have added CyberArk Software and Splunk.

Other recent additions include Snowflake, a cloud-based system for data warehousing, and the German chip manufacturer Infineon. Certain parts of the semiconductor sector offer the potential for strong growth – Infineon believes that the market for semiconductors selling into electric vehicles could grow by 22% a year between 2022-2027.5

Shocks in the short term, but the march of tech continues

While macroeconomic and geopolitical uncertainty continue, we would expect markets to remain volatile. The pressures from inflation, a strong US dollar, higher energy costs, and rising interest rates will continue to have a negative impact on consumer and businesses spending. Near term growth expectations will likely be reset over the coming months.

However, we believe the longer-term growth potential for many of the companies within the fund are likely to remain positive, and falling valuations are creating many attractive investment opportunities in the sector. We continue to focus on quality within our investment universe, identifying management teams who we believe can navigate their companies through these challenging times.

- U291cmNlOiBBWEEgSU0sIEJsb29tYmVyZywgTVNDSSBXb3JsZCBJbmRleCwgTVNDSSBXb3JsZCBUZWNoIEluZGV4LCBhcyBhdCBYWCBPY3RvYmVyIDIwMjIu

- U291cmNlOiBBWEEgSU0sIEJsb29tYmVyZywgTVNDSSBXb3JsZCBJbmRleCwgTVNDSSBXb3JsZCBUZWNoIEluZGV4LCBhcyBhdCBYWCBPY3RvYmVyIDIwMjIu

- U291cmNlOiBBWEEgSU0sIEJsb29tYmVyZywgTVNDSSBXb3JsZCBJbmRleCwgTVNDSSBXb3JsZCBUZWNoIEluZGV4LCBhcyBhdCBYWCBPY3RvYmVyIDIwMjIu

- U291cmNlOiBBWEEgSU0=

- U291cmNlOiBJbmZpbmVvbiBBdXRvbW90aXZlIERpdmlzaW9uIENhbGwsIDA0LzEwLzIwMjI=

Examples are provided for informational purposes only and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities.

Not for Retail distribution: This marketing communication is intended exclusively for Professional, Institutional or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

Additional risks:

Single Sector Risk: as this Fund is invested in a single sector, the Fund's value will be more closely aligned with the performance of that sector and it may be subject to greater fluctuations in value than more diversified funds.

Currency Risk: the Fund holds investments denominated in currencies other than the base currency of the Fund. As a result, exchange rate movements may cause the value of investments (and any income received from them) to fall or rise affecting the Fund's value.

Further explanation of the risks associated with an investment in this Fund can be found in the prospectus.

Long-term performance:

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Portfolio % | 22.71 | 49.46 | 34.07 |

7.28 |

30.21 |

| Benchmark % | 31.04 | 39.33 | 41.86 | 3.46 | 26.26 |

Past performance is not a reliable indicator of future results. Performance calculations are net of fees, based on the reinvestment of dividends. The index's performance is calculated on the basis of net dividend. Please refer to the fact sheet for more information.Benchmark is 100% MSCI World Information Technology Total Return Net. Source: AXA Investment Managers.

Global Technology

At the heart of this evolution are innovative companies driving change across the entire economy – including how we work, shop, build relationships and find information.

Find out moreDisclaimer

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Before making an investment, investors should read the relevant Prospectus and the Key Investor Information Document / scheme documents, which provide full product details including investment charges and risks. The information contained herein is not a substitute for those documents or for professional external advice.

The products or strategies discussed in this document may not be registered nor available in your jurisdiction. Please check the countries of registration with the asset manager, or on the web site https://www.axa-im.com/en/registration-map, where a fund registration map is available. In particular units of the funds may not be offered, sold or delivered to U.S. Persons within the meaning of Regulation S of the U.S. Securities Act of 1933. The tax treatment relating to the holding, acquisition or disposal of shares or units in the fund depends on each investor’s tax status or treatment and may be subject to change. Any potential investor is strongly encouraged to seek advice from its own tax advisors.

For more information on sustainability-related aspects please visit https://www.axa-im.com/what-is-sfdr

For investors located in the European Union :

Please note that the management company reserves the right, at any time, to no longer market the product(s) mentioned in this communication in the European Union by filing a notification to its supervision authority, in accordance with European passport rules.

In the event of dissatisfaction with AXA Investment Managers products or services, you have the right to make a complaint, either with the marketer or directly with the management company (more information on AXA IM complaints policy is available in English: https://www.axa-im.com/important-information/comments-and-complaints ). If you reside in one of the European Union countries, you also have the right to take legal or extra-judicial action at any time. The European online dispute resolution platform allows you to submit a complaint form (available at: https://ec.europa.eu/consumers/odr/main/index.cfm?event=main.home.chooseLanguage) and provides you with information on available means of redress (available at: https://ec.europa.eu/consumers/odr/main/?event=main.adr.show2).

Summary of investor rights in English is available on AXA IM website https://www.axa-im.com/important-information/summary-investor-rights. Translations into other languages are available on local AXA IM entities’ websites.

AXA Framlington Global Technology Fund is a part of AXA Framlington Range of Authorised Unit Trust Schemes and is managed by AXA Investment Managers UK Limited, part of the AXA IM Group.

AXA Investment Managers UK Limited, is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate, London EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Past performance is not a guide to current or future performance, and any performance or return data displayed does not take into account commissions and costs incurred when issuing or redeeming units. References to league tables and awards are not an indicator of future performance or places in league tables or awards and should not be construed as an endorsement of any AXA IM company or their products or services. Please refer to the websites of the sponsors/issuers for information regarding the criteria on which the awards/ratings are based. The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested. Exchange-rate fluctuations may also affect the value of their investment. Due to this and the initial charge that is usually made, an investment is not usually suitable as a short term holding.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.