UK equity: The not-so poor relation

KEY POINTS

A lack of enthusiasm for UK equities has seen ownership decline both domestically and globally, but a change in the UK economic environment could bring about a reversal of fortune. Nigel Yates, portfolio manager on the AXA Framlington UK Select Opportunities Fund, outlines why we think everything could be about to change for UK equities.

It’s a national pastime in the UK to look on the gloomy side of things, and it seems that when it comes to the economy the media can’t get enough of it. However, whisper it quietly: things are starting to improve. This is even before we see the inevitable interest rates cuts later this year as inflation falls to around the target level of 2%.

What is the evidence for this? There has been a whole raft of economic data points recently that clearly show things are turning around. For example, the Asda Income tracker1 is at a two-year high thanks to falling inflation, robust wage growth and tax cuts. Higher incomes are feeding through to higher levels of consumer confidence2 and business confidence is also at its strongest level since 20173. Peaking rates and falling inflation are usually positive for equities. Just don’t expect to hear this widely reported in the mainstream press.

- {https://corporate.asda.com/newsroom/2024/02/21/household-disposable-income-the-highest-in-almost-two-years-as-inflation-slows;Household disposable income the highest in almost two years as inflation slows (asda.com)}

- {https://www.gfk.com/press/consumer-confidence-up-three-points-to-19-in-january;UK Consumer confidence up three points to -19 in January (gfk.com)}

- {https://www.lloydsbankinggroup.com/media/press-releases/2021/lloyds-bank/business-confidence-surges-four-year-high.html#:~:text=Business%20confidence%20increased%20by%20six%20points%20to%2036%25,of%20businesses%20predicting%20rises%20of%20at%20least%202%25.;Business confidence surges to four-year high - Lloyds Banking Group plc}

There’s more to the UK market than meets the eye

Another common misconception is that the UK market is made up of cyclical, capital-intensive, ‘old economy’ companies. Scratch beneath the surface and you will find plenty of exciting companies aligned to the global mega-trends of digitalisation, energy transition and changing demographics.

We look for companies with the following key characteristics:

- strong balance sheet

- high margins

- defendable economic moat

- Capital allocation policy that prioritises organic investment

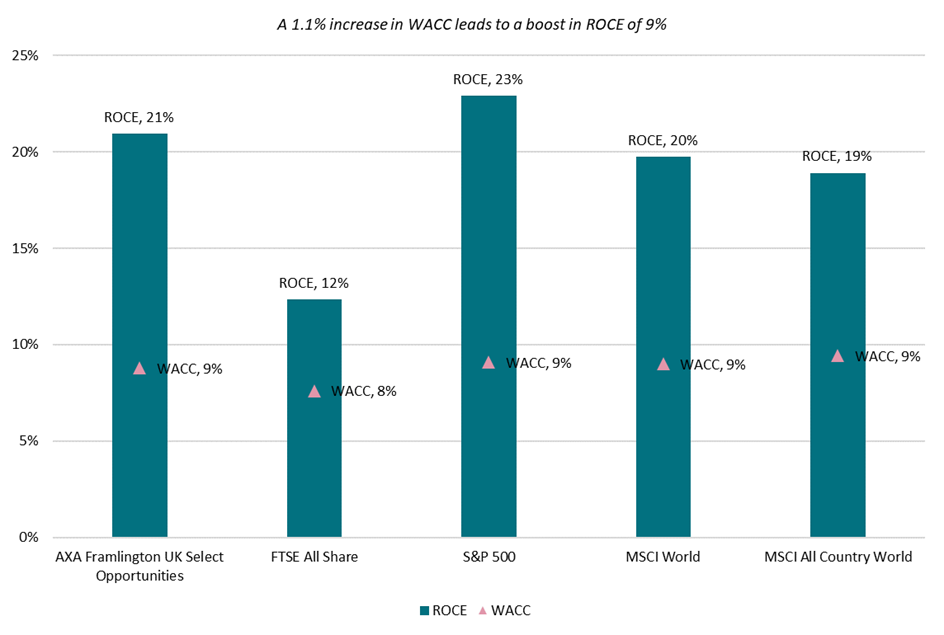

However, probably the most important metric is their return on capital employed (ROCE) as this is ultimate measure of profit and performance and the main driver of free cash flow.

I know you will have been inundated with Charlie Munger quotes recently, but this is one of my favourites:

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result."

I like it because it speaks to being patient and to investing in quality companies, the same investment philosophy that we use for the UK Select Opportunities strategy.

The chart below shows the 2024 ROCE of the strategy and its comparison to a variety of markets. What is pleasing to see is that it is above Charlie’s 18%, significantly higher than the UK market and comparable with the S&P 500.

Is shareholder value being created?

Source: AXA Investment Managers/Factset/Bloomberg, as at 26 February 2024. Calculated in sterling. Past performance is not a reliable indicator of future results.

The UK market is also renowned for its global leadership in corporate governance standards. Unlike many global companies, UK corporates have been quick to have their carbon reduction targets validated by the Science Based Targets Initiative (SBTi) and employment practices aligned to the Living Wage foundation.

We look for sustainability as a superior business model. This can take many forms. For example:

- Is the board adequately rigorous and experienced to challenge and support the management teams?

- Can a company’s products and services capitalise from their superior efficiency or reduced raw material use (such as Weir’s products within the mining industry)?

- Companies that prioritise engaging, training and empowering employees are often rewarded with higher retention levels, more innovation and better customer satisfaction (such as Cranswick).

Is Mr Market looking the other way?

So, we have a portfolio of good-quality companies in an improving economy that has falling inflation and possible interest rate cuts. Surely the stock market has seen this coming and priced the recovery?

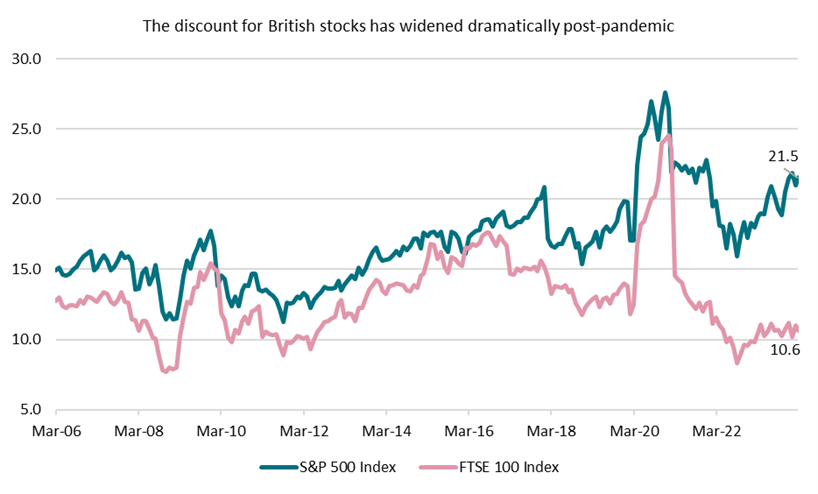

In short, no. In a global context the UK divergence looks to be increasing.

UK stocks are cheap compared to other markets

Source: AXA Investment Managers/Factset, March 2024. Price-earnings, calculated on a sterling basis. Past performance is not a reliable indicator of future results.

While the global divergence isn’t really news, even within the UK investors seem to be overlooking the potential: the FTSE 250 and FTSE Small Cap (the markets most geared into a UK recovery) are both trading well below their 20-year average.

Valuations are well below 20-year averages

Source: AXA Investment Managers/Factset, March 2024. Forward price-earnings, sterling basis, NTM. Past performance is not a reliable indicator of future results.

While investors, globally and locally, may be ignoring the opportunity, it has not gone unnoticed by global private equity and international corporations with a notable recent pick up in M&A activity such as the fund’s position in Spirent Communications. There have been nine approaches of note so far this year accounting for a total of £17.5bn, compared to less than £17bn for the whole of 2023.

You know what they say: if you can’t beat them, join them.

Disclaimer

Not for Retail distribution: This marketing communication is intended exclusively for Professional, Institutional or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

FTSE International Limited (“FTSE”) © FTSE 2024. FTSE® is a trade mark of London Stock Exchange Plc and The Financial Times Limited and is used by FTSE under licence. All rights in the FTSE Indices vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE Indices or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.

Information concerning portfolio holdings and sector allocation is subject to change and, unless otherwise noted herein, is representative of the target portfolio for the investment strategy described herein and does not reflect an actual account.

AXA Framlington UK Select Equity Fund is a part of AXA Framlington Range of Authorised Unit Trust Schemes and is managed by AXA Investment Managers UK Limited, part of the AXA IM Group.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.