2024: A stand-out year for UK mid-caps?

- 24 April 2024 (5 min read)

Depressed valuations and an improving economic outlook present an opportunity in UK mid-cap stocks that doesn’t come around very often, argues Chris St John, portfolio manager of the AXA Framlington UK Mid Cap Fund. The scene is being set for fundamental stock-picking, driven by company fundamentals, to be the differentiator for UK mid-cap investors.

Performance of UK mid-cap stocks has been improving. 2023 ended on a high, with the FTSE 250 Index outperforming the FTSE 100 in the final quarter of 2023 by around 7%. We think this positive momentum is likely to continue in 2024, thanks to an improving economic backdrop.

An improving economic backdrop will benefit UK stocks

As well as greater exposure to the domestic market, mid-caps are more sensitive to changes in local economic conditions. Therefore, indications that the UK economy is recovering should be particularly beneficial to mid-cap stocks.

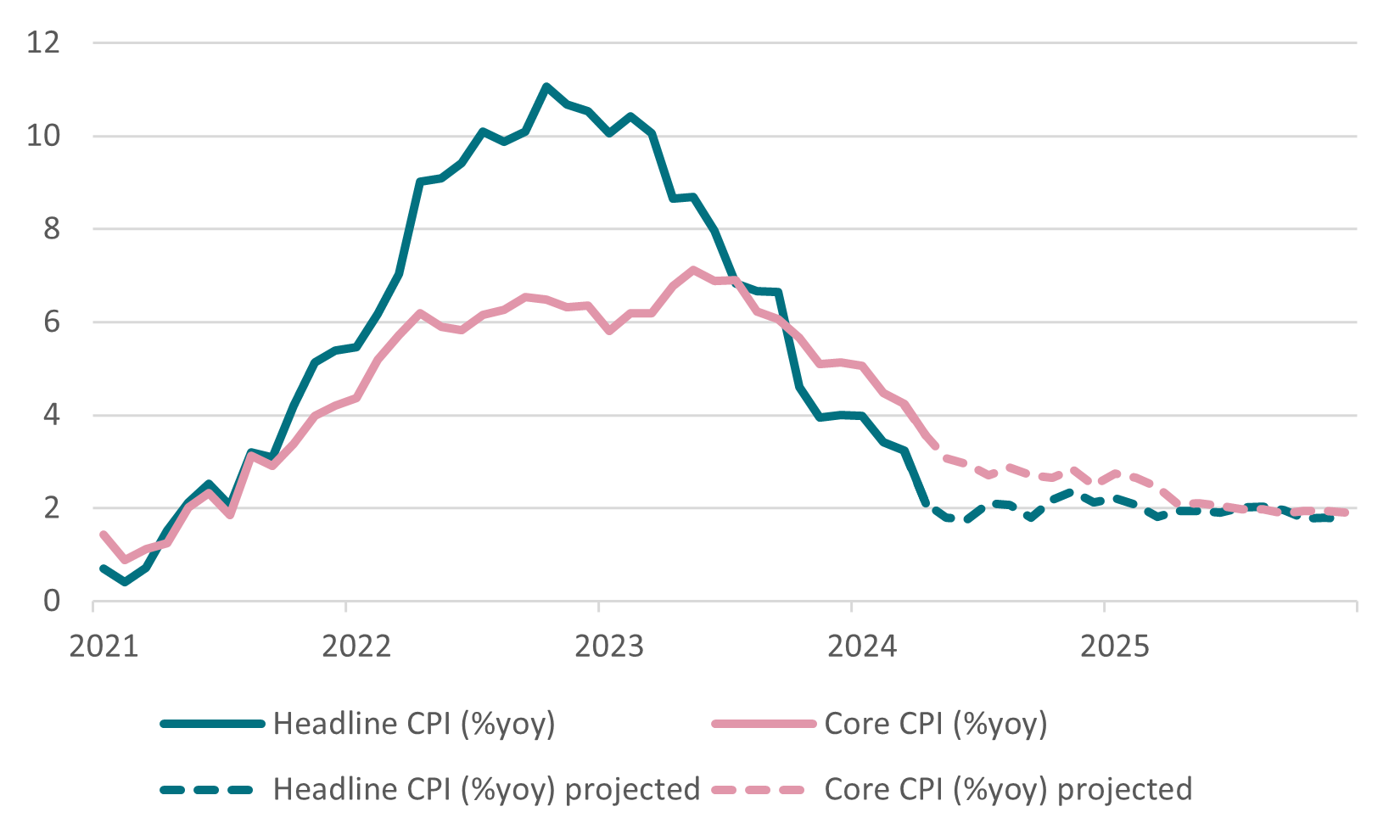

- Inflation is falling – CPI inflation is set to fall below 2% in Q2 2024 and core inflation is also falling, albeit more slowly.

UK inflation is forecast to keep falling

Source: Office of National Statistics, Haver Analytics, Barclays Research, April 2024. Past performance is not a guide to future performance.

- A turn in the interest rate cycle will put company fundamentals centre stage once more – Interest rates have risen so far and so fast that the impact on UK share prices has far outweighed the underlying potential of many companies; as rates fall, company fundamentals will become a more important factor in valuations.

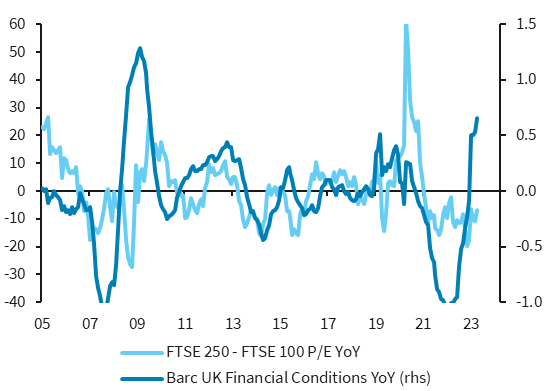

- Easing financial conditions should help a re-rating – Falling inflation and interest rates are creating a backdrop that will make it easier for companies with strong balance sheets to invest and grow.

UK small caps/domestics P/E should be helped by financial conditions easing

Source: LSEG Data &Analytics, Barclays Research. April2024. Past performance is not a guide to future performance.

- A reproachment with Europe could drive improvements in exports and trade – Europe is a key market for UK mid-cap companies, and both PM Rishi Sunak and the leader of the opposition Keir Starmer have indicated that they want to improve the trading relationships with the Europe Union.

- An improving economy is building back consumer confidence – Falling inflation has seen the cost-of-living crisis abating, and consumer confidence rising as real incomes rise and personal debt levels fall; companies ready to partake in rising consumer spending will benefit.

Challenges remain. Growth is anaemic, productivity growth remains elusive despite being the focus of government policy, long-term sickness is an issue and trade policy is not as supportive as we would wish. Geopolitics also remains a risk.

A general election is due this year, but the risks are on the upside. Crucially in this regard both the incumbent government and the opposition Labour Party are presenting cautious, market-friendly policies that are unlikely to derail improving economic trends.

The mid-cap space favours thoughtful stock pickers

The FTSE 250 has a number of characteristics that favour stock pickers. The constant evolution of the index, as rising small caps enter and established players graduate into the FTSE 100, creates a dynamic investment universe, continually refreshing itself.

Skill and experience are required to understand the factors that can identify companies with the potential to outperform. Mid-cap companies can also be more idiosyncratic than larger companies with well-established brands in traditional sectors.

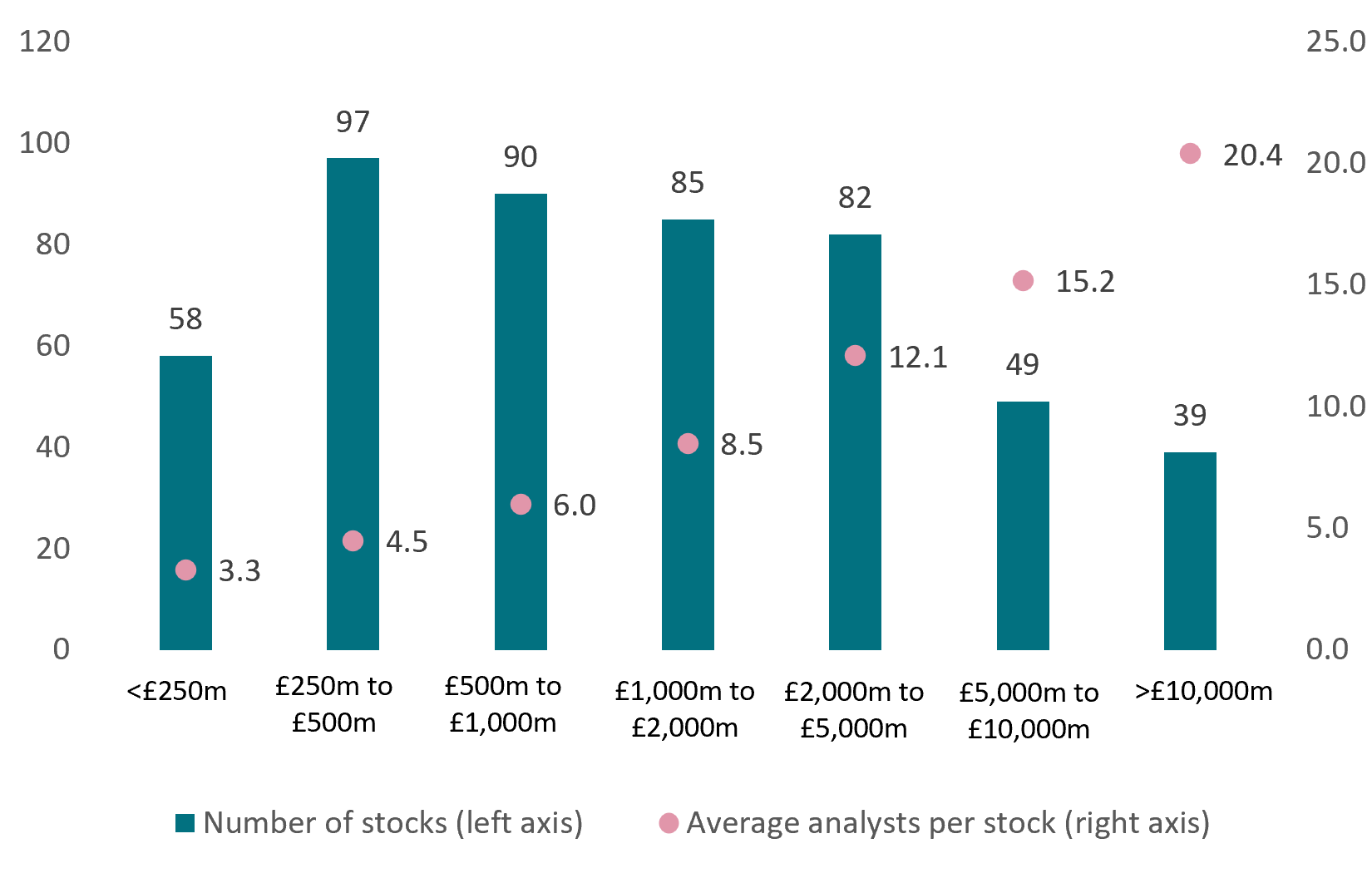

But despite this, analytical coverage of UK stocks outside of the large-cap space is relatively sparse. This is creating opportunities for investors with the skills and resources required to sort the potential winners from the also-rans.

The further down the cap scale you go, the fewer analysts there are

Distribution of FTSE All Share stocks by market cap and average analyst per stock. Source: HSBC Global Research – UK Mid-Caps, February 2019. Source: Refinitiv Datastream, HSBC calculations. CR11683/02-20

Fundamental research is key to finding outperformers

Our investment philosophy is driven by a small number of core beliefs.

- Risk management is paramount – we actively mitigate credit risk, stock concentration, and share price volatility by prioritising balance sheet strength, sustainable business practices, absolute valuation, portfolio diversification and a long investment horizon.

- Profitable turnover growth is the primary driver of long-term equity return – companies that can continually increase their economic output will become more valuable over time.

- Balance sheet strength is a necessary prerequisite for attractive risk adjusted returns – we favour companies that can reinvest capital at attractive rates to strengthen their competitive advantage, drive profitable revenue growth, develop sustainability practices, conduct M&A, and raise dividends or buy-back shares to create value for shareholders.

- A structural focus on short-term earnings leads markets to underestimate the power of long-term compounding – low analyst coverage accentuates these pricing inefficiencies.

- Fundamental factors drive the intrinsic value of assets – we focus on absolute valuation and seek to identify companies that are undervalued relative to their ability to compound earnings over the long term.

With valuations at historically attractive levels, we believe that 2024 presents an almost unique opportunity for UK equity investors. UK stocks could be on the cusp of a significant positive rerating. In our view, finding the companies with the most to gain, through patient and comprehensive fundamental analysis, is the surest path to outperformance in a sector that could see considerable gains in 2024 and 2025.

Related articles

View all articles

Generative AI: The future of e-commerce is here

- by

- 30 April 2024 (7 min read)

2024: A stand-out year for UK mid-caps?

- by Chris St John

- 24 April 2024 (5 min read)

Meet The Managers - Q&A with Chris Eccles and Catherine Tennyson

- by ,

- 08 April 2024 (5 min read)

UK equity: The not-so poor relation

- by Nigel Yates

- 28 March 2024 (5 min read)

Investing in tech for sustainability

- by

- 27 March 2024 (5 min read)

Meet the Manager - Q&A with Anna Väänänen

- by

- 07 March 2024 (3 min read)

Disclaimer

Not for Retail distribution: This marketing communication is intended exclusively for Professional, Institutional or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document. Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.