The role of credit in the new UK pensions landscape

- 28 February 2023 (5 min read)

Key points:

- Following a turbulent six months for UK pensions, trustees may wish to review the role of credit in their portfolios given the now more attractive characteristics of the asset class, post the Liability Driven Investment (LDI) crisis

- Liquidity is essential for UK defined benefit pension schemes and there are several tools available within Cashflow Driven Investment (CDI) portfolios such as expanding the investible universe and considering credit repurchase agreements

- We believe there could be systemic, operational and performance-related risks from the ‘grab for assets’ by LDI managers seeking to take over CDI portfolios to stockpile collateral buffers even further

Last year delivered one of the most turbulent 12 months in history for UK defined benefit pension schemes owing to the crisis around liability-driven investments (LDI) that followed then-Prime Minister Liz Truss’s tax-cutting budget.

These events made us further consider the role of certain investment strategies and examine whether there are better ways to manage portfolios to ensure they remain resilient in the face of future market events.

What is the role of credit in UK pension scheme portfolios?

UK pension scheme allocations to credit have grown steadily as their focus has shifted from funding level improvements to paying member benefits when due. Not only was credit able to deliver those timely cashflow payments before the LDI crisis, but also on three other important objectives: contributing to the interest rate hedging of a scheme’s liabilities; achieving a moderate spread over government bonds to maintain or improve funding levels; and offering liquidity when required.

During the LDI crisis, credit’s liquidity was by far and away its most important characteristic as many schemes were forced to sell holdings to fulfil LDI collateral requirements. Some schemes may have found themselves stomaching losses as they scrambled to raise the cash needed to meet counterparty banks’ margin calls.

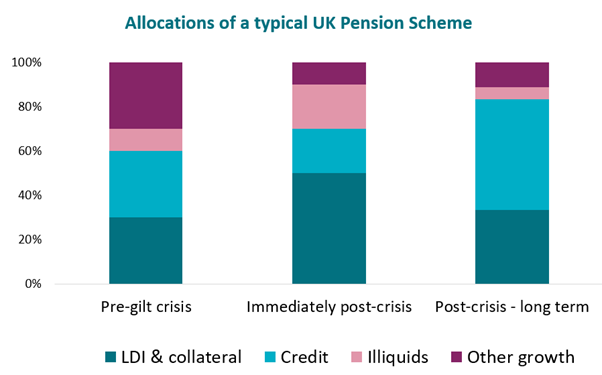

The asset allocation of schemes could look quite different post-crisis. For example, the allocation to LDI will undoubtably have changed as larger collateral buffers are now required to avoid a similar event. On the other end of the spectrum, illiquid asset allocations - as a percentage of total scheme assets - may also have risen, as schemes may have been unable to redeem such holdings (as the name suggests) and a scheme’s value will have fallen. In the ‘middle’ of the asset class categories, public equity and credit allocations will have decreased in the near-term having been sold for collateral calls and as funding levels improved generally.

How could UK DB Pension Scheme allocations change?

Source: AXA IM estimates and projections. For illustrative purposes only and subject to change.

But as we move beyond the impacts of the LDI crisis, what role does credit have in pension schemes’ future asset allocations? We believe credit will have much greater importance for defined benefit (DB) schemes, as each of the four potential benefits provided before and during the crisis are now further enhanced.

- Liquidity – Credit proved its resilience and ability to provide liquidity during the LDI crisis. While the structural liquidity of credit markets has not changed, having the proof that it can be called upon when required increases the attractiveness of credit as part of a pension scheme’s allocation - which is covered further down

- Returns – Credit has always offered a greater return potential than government bonds owing to an invariably greater yield, known as the credit spread. With those spreads now wider than they were before the LDI crisis, and with potential additional return requirements following the sale of illiquid assets, we expect the appeal of credit to have increased for many

- Cashflow delivery – The steadfast ability of well-structured, resilient credit portfolios to deliver stable and timely cashflows for schemes continues - based on our observations before, during and after the crisis – and as many schemes are now better funded, greater focus can be given to securing their member payments

- Hedging – The greatest difference since the LDI crisis is the importance of credit in taking up some of the heavy lifting of interest rate hedging from LDI portfolios, now that LDI portfolios need an even greater amount of capital to deliver the required hedge. Diversifying sources of interest rate risk between asset classes and across managers can significantly reduce operational risks for pension schemes

We see this as an important step change in the attractiveness of credit as an asset class. And we believe schemes should consider a larger allocation, as redemption proceeds from illiquid asset sales are realised, and as they aim to reduce reliance on complex leveraged LDI strategies to provide all their interest rate hedging.

Enhancing liquidity in credit portfolios

An essential liquidity source for UK institutional credit investors is to access non-sterling assets. The euro and dollar markets are significantly larger than the UK credit market and offer not only potential relative value opportunities and risk mitigation, but also the opportunity to diversify schemes’ sources of liquidity. The US dollar market, for example, held up relatively well throughout the LDI crisis and therefore portfolio managers could sell dollar bonds at a better price than the sterling market. The opposite occurred during the initial sell-off caused by the COVID-19 crisis where the dollar market faced a significant sell-off, while the sterling and euro markets stayed relatively firm.

With any fixed income portfolio, the importance of trading is critical to achieve best execution for clients. However, credit and government bond trading differ slightly in this regard – government bonds have very little price differential and therefore bond pricing and the ability to trade is relatively standard. Within credit, prices can vary more considerably and what is often underappreciated is the simple ability to trade bonds in times of market stress – it is here when the scale, quality and connections of the active trading platform are defining factors when executing trades and securing best pricing.

As with diversification into non-sterling credit markets, investing outside of traditional corporate credit can both diversify sources of liquidity and sources of returns. Some parts of the Asset-Backed Securities (ABS) market, such as high-quality and liquid ABS, are good examples of this. Not only are the drivers of returns different (consumer credit primarily for the ABS market, versus corporate risk for traditional credit), but so are the pools of liquidity. Investing in ABS as part of a holistic cashflow driven investing (CDI) solution can help improve liquidity for UK pension scheme portfolios, in our view. Combining traditional credit and ABS within the same mandate may enable even greater flexibility as portfolio managers should be able to actively determine the best source of liquidity at the time of need, rather than a segmented approach. This is similar to how combining the two sub-asset classes can enable managers to find the best areas of relative value.

During the LDI crisis we found that one area of the credit market which typically offers excellent liquidity in a normal market environment – quasi-sovereigns such as issues from local government bodies – were difficult to transact, possibly as these are widely held by UK pension funds. This goes to prove that areas of liquidity during normal markets don’t necessarily follow through to liquidity in market sell-offs and depending on the reason for the crisis, different sub-sectors can deliver liquidity, at different points. We believe this only highlights the need for a broad and diversified investible universe from a long-term financial perspective - and also to generate immediate liquidity in times of need.

Although investing in non-sterling and ABS assets can dip into different pools of liquidity, pension schemes can also consider using credit repurchase agreements (repos), to raise liquidity without selling bonds and incurring the associated transition costs. A credit repo transaction involves using a portion of a portfolio as collateral for a counterparty bank to lend money against. This borrowed cash can then be either used within the portfolio or as liquidity elsewhere in the pension scheme. The clear benefit here is that exposure to the fixed income market and resulting cashflows are retained while still providing up to a third of the portfolio size in cash outside of the portfolio. We believe credit repos should be used within a risk-controlled framework and only in acute liquidity squeezes to avoid shifting leverage from LDI mandates to CDI mandates.

Should all LDI and CDI assets be pooled together?

Trustees may also need to consider the non-negligible risks of manager concentration with LDI managers. UK pension funds and their consultants have always championed the need to select best-in-class managers for each individual strategy, and the 2022 LDI-crisis may threaten this.

LDI and CDI are two different but complementary strategies and each requires a separate skill set. On the one hand, LDI aims to match the interest rate and inflation sensitivity of a portion of pension scheme assets, typically using gilts, swaps and repos. The number of available instruments to use is limited. Leverage management, accuracy of hedge and access to the gilt market are crucial components of an LDI strategy.

On the other side, CDI strategies are designed to contribute to the income requirements of schemes and invest in corporate bonds and other income-generating assets. The skillset here is entirely different with a strong focus on limiting downgrade and default risk through deep fundamental credit research, minimising trading costs to avoid capital erosion, and finding the best relative value across a vast universe of investible credit assets.

What then, are the risks of ‘the grab for assets’ that industry participants have warned of, where LDI managers claim they must manage both LDI and CDI strategies to fulfil their collateral requirements?

We believe there is a systemic risk from having a very small number of market participants in a relatively shallow market such as the UK credit market, the core asset class in many CDI portfolios. Portfolios run by the same manager are likely to be very similar and therefore if another market event were to occur, the resulting sell-off could cause enormous skews in the credit market and even a similar crisis to that of September/October 2022.

In additional, although housing LDI and CDI together may appear to ease governance concerns, the two teams are typically run by separate teams. Therefore, separate due diligence reviews and meetings will still be needed, given how different the performance assessment and skillset required is. This is especially true when using pooled LDI portfolios where any perceived easing of governance requirements may be completely erased. Further, it begs the question of what occurs if the trustees wish to replace one of the two component strategies – can they only exit as a pair now, even if one of the respective components is performing as expected?

For many schemes, their CDI portfolio – at between 20% and 50% of their total scheme size – can be one of their largest allocations, making the performance of the strategy critical to the scheme achieving its financial goals. With default rates, which have been close to zero for nearly a decade, now rising towards historical averages, we may be heading into a period marked by a greater dispersion of credit returns between issuers. Achieving the best possible performance (capital growth and predictability of cashflows) throughout this period will be crucial to help schemes reach their endgame goals.

In conclusion we believe trustees should continue to focus on selecting best-in-class credit managers to run their CDI portfolios to achieve their desired financial objectives.

Cashflow Driven Investing

CDI is changing the defined benefit pensions investment landscape.

Find out moreDisclaimer

Not for Retail distribution: This marketing communication is intended exclusively for Professional, Institutional or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries. © AXA Investment Managers, 2023

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.