Why AXA IM US Short Duration High Yield?

We believe our Short Duration High Yield strategy has produced stable, consistent, and positive total returns for over 20 years.

Key characteristics

- Invests in securities with expected take-outs of <3 years

- Focused on better quality, improving high yield credits

- Compounds coupon income available to high yield investors while avoiding principal losses

- Targets to generate attractive liquidity profile through natural turnover and coupon interest

Why invest in short duration high yield bonds?

- Focus on capturing coupon income, which historically has driven returns in the high yield market

- Natural turnover allows reinvestment into current market environment to capture prevailing opportunities

- Less sensitivity to interest rate movements against broad US high yield market

- Short duration makes up the most liquid portion of the high yield market

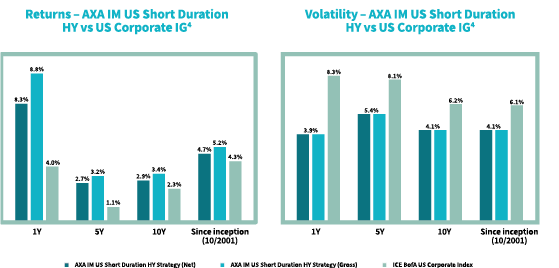

US Short Duration HY vs US IG

Our strategy has consistently outperformed the US Corporate IG Index while maintaining lower volatility.4

- QVhBIEludmVzdG1lbnQgTWFuYWdlcnMgZm9yIDUgeWVhciBwZXJpb2QgZW5kaW5nIFNlcHRlbWJlciAzMCwgMjAyMy4gRm9yIGlsbHVzdHJhdGl2ZSBwdXJwb3NlcyBvbmx5LiBObyBhc3N1cmFuY2UgY2FuIGJlIGdpdmVuIHRoYXQgdGhlIHN0cmF0ZWd5IHdpbGwgYmUgc3VjY2Vzc2Z1bCBvciB0aGF0IGludmVzdG9ycyB3aWxsIGFjaGlldmUgaXRzIG9iamVjdGl2ZXMuIFRoZSByZXByZXNlbnRhdGl2ZSBhY2NvdW50IHNob3duIGhhcyBiZWVuIHNlbGVjdGVkIGJlY2F1c2UgaXQgdXRpbGl6ZXMgYW4gaW52ZXN0bWVudCBzZXR1cCB0aGF0IGlzIHR5cGljYWwgZm9yIGFjY291bnRzIGluIHRoZSByZWxldmFudCBzdHJhdGVneSBhbmQvb3Igb24gdGhlIGJhc2lzIHRoYXQgaXQgaGFzIGFkZXF1YXRlIGFzc2V0cyB1bmRlciBtYW5hZ2VtZW50IHRvIGVmZmVjdHVhdGUgYSBmYWlyIGNvbXBhcmlzb24uIFBsZWFzZSByZWZlciB0byB0aGUgYXBwZW5kaXggZm9yIGFkZGl0aW9uYWwgaW5mb3JtYXRpb24u

Short Duration Bonds

Offer a first step onto the credit ladder with less uncertainty

Learn moreStrategy Risks

CREDIT RISK - If an issuer of bonds defaults on its obligations to pay income or repay capital, it may result in a decrease in portfolio value. The value of a bond (and subsequently, the portfolio) is also affected by changes in credit rating downgrades and/ or market perceptions of the risk of future default. Investment grade issuers are regarded as less likely to default than issuers of high yield bonds. High-yield, lower-rated, securities involve greater risk than higher-rated securities. Portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not.

RISK OF CAPITAL LOSS – Any investment in our high yield strategies are not guaranteed and returns can be negative. The performance of a portfolio may not be consistent with the objectives of investors and their investment may not be fully returned.

INTEREST RATE RISK - Fluctuations in interest r.ates will change the value of bonds, impacting the value of the investment portfolio Often, when interest rates rise, the value of the bonds fall and vice versa. The valuation of bonds will also change according to market perceptions of future movements in interest rates.

LIQUIDITY RISK - Some investments may trade infrequently and in small volumes and the risk of low liquidity level in certain market conditions might lead to difficulties in valuing, purchasing or selling bonds.

HIGH YIELD BOND RISK - The portfolio will be exposed to a risk related to investments in high yield financial instruments. These instruments present higher default risks than those of the investment grade category. In case of default, the value of these instruments may decrease significantly, which would affect the value of the portfolio. Lower-rated securities generally tend to reflect short-term corporate and market developments to a greater extent than higher-rated securities which respond primarily to fluctuations in the general level of interest rates.

RE-INVESTMENT RISK - Reinvestment risk describes the risk that, as interest rates or market environment changes, the future coupons and principal from any bond may have to be reinvested in a less favorable rate environment. This is more likely to occur during periods of declining interest rates when issuers can issue bonds with lower levels of coupon. Re-investment risk may be greater with callable bonds.

Non-USD investors in offshore vehicles advised or sub-advised, in whole or in part, by the Adviser employing the investment strategy described herein may be subject to currency exchange risk.

Disclaimer

Not for Retail distribution: This marketing communication is intended exclusively for Professional, Institutional or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly. This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision. Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Past performance is not a guide to current or future performance, and any performance or return data displayed does not take into account commissions and costs incurred when issuing or redeeming units. References to league tables and awards are not an indicator of future performance or places in league tables or awards and should not be construed as an endorsement of any AXA IM company or their products or services. Please refer to the websites of the sponsors/issuers for information regarding the criteria on which the awards/ratings are based. The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested. Exchange-rate fluctuations may also affect the value of their investment. Due to this and the initial charge that is usually made, an investment is not usually suitable as a short term holding.

Information concerning portfolio holdings and sector allocation is subject to change and, unless otherwise noted herein, is representative of the target portfolio for the investment strategy described herein and does not reflect an actual account . The performance information shown herein reflects the performance of a composite of accounts that does not necessarily reflect the performance that any particular account investing in the same or similar securities may have had during the period. Actual portfolios may differ as a result of client-imposed investment restrictions, the timing of client investments and market, economic and individual company considerations. The holdings shown herein should not be considered a recommendation or solicitation to buy or sell any particular security, do not represent all of the securities purchased, sold or recommended for any particular advisory client, and in the aggregate may represent only a small percentage of an account’s portfolio holdings.

Representative Accounts have been selected based on objective, non-performance based criteria, including, but not limited to the size and the overall duration of the management of the account, the type of investment strategies and the asset selection procedures in place. Therefore, the results portrayed relate only to such accounts and are not indicative of the future performance of such accounts or other accounts, products and/or services described herein. In addition, these results may be similar to the applicable GIPS composite results, but they are not identical and are not being presented as such. Account performance will vary based upon the inception date of the account, restrictions on the account, along with other factors, and may not equal the performance of the representative accounts presented herein. The performance results for representative accounts are gross of all fees and do reflect the reinvestment of dividends or other earnings.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.